From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

Corrected Billboard Applauds Corporate Tax Loopholes

The California Department of Corrections (CDC) has unveiled a new billboard campaign to applaud American corporations for their consistent profits despite the burden of federal income tax.

On March 7, 2014, the CDC successfully apprehended and rehabilitated a San Francisco billboard at the intersection of Cesar Chavez and Mississippi Street, next to the city's Caltrain railroad line.

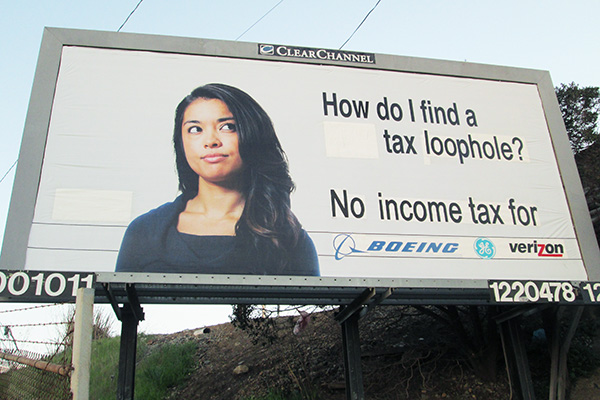

Discharged in time for the 2014 tax season, the CDC billboard features a woman set against a white background and surrounded by simple black lettering reminiscent of federal tax forms. Looking slightly confused and frustrated, she asks, HOW DO I FIND A TAX LOOPHOLE? In matching typeface the bottom of the billboard reads, NO INCOME TAX FOR BOEING, GE and VERIZON. Each of the three companies is represented by its corporate logo.

The liberated ad can be seen on the CDC website at http://www.CorrectionsDepartment.org.

The billboard was released from CDC custody one week after the nonpartisan Center for Tax Justice, http://www.ctj.org, published a report comparing the profits and income taxes for Fortune 500 companies. One hundred and eleven of the companies under investigation paid zero or less in federal income taxes for at least one year between 2008 and 2012. Twenty-six of these corporations, including Boeing, General Electric and Verizon, generated a combined total of $170 billion in profits, but maintained negative tax rates every year from 2008 to 2012.

As a private correctional facility, the California Department of Corrections recognizes that the business community is often more efficient and cost effective than government institutions. The current U.S. tax code is a barrier to greater efficiency in the private sector. Between 2008 and 2012 many Fortune 500 companies experienced limited growth, accumulating only $360 billion in tax subsidies. However, the CDC believes that our colleagues in the federal government can do more to stimulate economic productivity. The CDC encourages the Internal Revenue Service (IRS) to streamline the U.S. tax code, expand long-term, negative tax benefits to every Fortune 500 company and provide all American corporations with annual cash payments equal to 35% of company profits.

The rehabilitated advertisement is currently at liberty and seems to have successfully readjusted to public life. However, this ad will remain under surveillance by department staff to prevent recidivism and any potential lapse into prior criminal behavior.

Founded in 1994, the CDC is a private correctional facility that protects the public through the secure management, discipline, and rehabilitation of Californias advertising. The department was initiated by individuals who felt that public correctional facilities were insufficiently managing the state's most criminal elements and that effective care and treatment would improve under the supervision of a private institution.

For more information on the operations and programs of the CDC, contact the California Department of Corrections Office of Communications at cdc [at] revolutionist.com.

Discharged in time for the 2014 tax season, the CDC billboard features a woman set against a white background and surrounded by simple black lettering reminiscent of federal tax forms. Looking slightly confused and frustrated, she asks, HOW DO I FIND A TAX LOOPHOLE? In matching typeface the bottom of the billboard reads, NO INCOME TAX FOR BOEING, GE and VERIZON. Each of the three companies is represented by its corporate logo.

The liberated ad can be seen on the CDC website at http://www.CorrectionsDepartment.org.

The billboard was released from CDC custody one week after the nonpartisan Center for Tax Justice, http://www.ctj.org, published a report comparing the profits and income taxes for Fortune 500 companies. One hundred and eleven of the companies under investigation paid zero or less in federal income taxes for at least one year between 2008 and 2012. Twenty-six of these corporations, including Boeing, General Electric and Verizon, generated a combined total of $170 billion in profits, but maintained negative tax rates every year from 2008 to 2012.

As a private correctional facility, the California Department of Corrections recognizes that the business community is often more efficient and cost effective than government institutions. The current U.S. tax code is a barrier to greater efficiency in the private sector. Between 2008 and 2012 many Fortune 500 companies experienced limited growth, accumulating only $360 billion in tax subsidies. However, the CDC believes that our colleagues in the federal government can do more to stimulate economic productivity. The CDC encourages the Internal Revenue Service (IRS) to streamline the U.S. tax code, expand long-term, negative tax benefits to every Fortune 500 company and provide all American corporations with annual cash payments equal to 35% of company profits.

The rehabilitated advertisement is currently at liberty and seems to have successfully readjusted to public life. However, this ad will remain under surveillance by department staff to prevent recidivism and any potential lapse into prior criminal behavior.

Founded in 1994, the CDC is a private correctional facility that protects the public through the secure management, discipline, and rehabilitation of Californias advertising. The department was initiated by individuals who felt that public correctional facilities were insufficiently managing the state's most criminal elements and that effective care and treatment would improve under the supervision of a private institution.

For more information on the operations and programs of the CDC, contact the California Department of Corrections Office of Communications at cdc [at] revolutionist.com.

For more information:

http://www.CorrectionsDepartment.org

Add Your Comments

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network