From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

The Economics of Building a Nuclear Power Plant in Fresno

It was only seven years ago when the promise of cheap electricity through deregulation helped plunge California into a deeper budget crisis and robbed ratepayers of their hard earned money. They are poised to do it again. Nuclear proponents are grateful for our citizenry’s short memories. Now, nuclear power advocates promise cheap, clean, safe energy and jobs. This section focuses on the economic viability of nuclear versus renewable energy and conservation.

The Fresno Nuclear Energy Group LLC is proposing a 1600 megawatt nuclear power plant costing $4 billion.

History tells us that projected costs differ vastly from actual costs. Just look at the table below:

PROJECTED VS. ACTUAL COST OF SELECTED NUCLEAR POWER PLANTS

(in billions of dollars)

Unit Megawatts Initial cost estimate Actual cost

Millstone III (Massachusetts and Connecticut) 1,150 .400 3.82

Limerick 1 (Pennsylvania) 1,055 .344 3.80

Wolf Creek (Kansas) 1,055 1.03 2.93

Susquehanna 1 (Pennsylvania) 1,050 .665 2.05

Susquehanna II (Pennsylvania) 1,050 .720 2.05

Source: Public Utility Commissions in the respective states

http://www.21stcenturysciencetech.com/articles/spring01/nuclear_power.html

As you can see, actual costs range from 3 to 11 times projected costs. Nuclear proponents argue that much of the added costs are because of unnecessary environmental and safety regulations, politics and finance issues. Whatever the reason, the reality is that the actual cost would likely exceed $12 billion. If nuclear is such a good investment, why have no nuclear power plant ever been 100% privately funded? In Dick Cheney’s Energy Policy of 2003, Title IV, subtitle B: New Nuclear Plants , it authorizes the Department of Energy to provide 50% of the costs to build new reactors and there are no guidelines regarding interest rates and repayment of these loans. In layman’s terms, we heavily subsidize the building of the plant. We do not share in the profits of the privately owned plant and there is no guarantee our financing will be paid back? If it is so safe, why does provision Title IV, subtitle A: The Price Anderson Act limit the liability of nuclear power plants to $10B. A serious nuclear accident according to Sandia National Laboratories could cost upwards of $300B. Taxpayers will pay the difference.

John Hutson, Chairman of the PUC and President/CEO of the Fresno Nuclear Energy Group LLC, claims nuclear will bring jobs. Undoubtedly, but let’s look at the job creation comparison for different energy sources:

Table 1. Jobs Involved in Producing 1000 Gigawatt-hours of Electricity Per Year

Number of jobs: 10 116 248 542

Energy source: Nuclear fission Coal Solar thermal Wind

This 1993 finding by the Worldwatch Institute should still apply today on a comparative basis. There is no doubt that job creation for renewable energy exceeds that of fossil fuel and nuclear energy. Many states are ignoring the direction of the Federal government and finding more economic benefits in pursuing green energy.

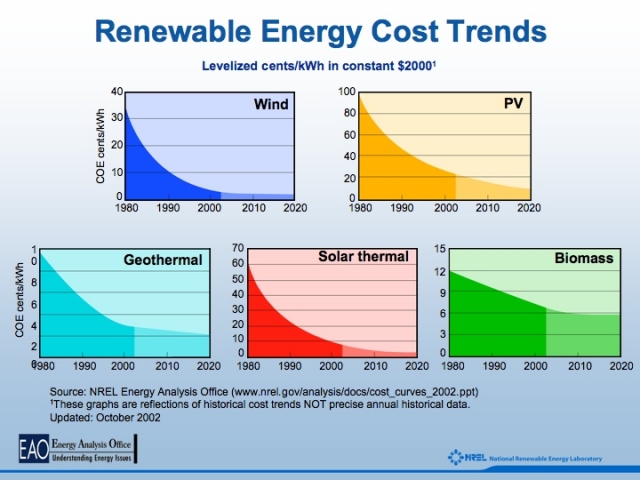

Since 1980 the cost of wind power has declined from $.30 - $.45 per kWh to $.05/kWh . The Federal Production Tax Credit, currently at 1.9 cents/kWh and indexed to inflation , further drives down the cost of wind power to ratepayers, allowing utility power purchase agreements to be signed as low as 3.5 cents. Solar photovoltaic (PV) is about $.20/kWh, and is now reduced with an expanded 30% Federal Investment Tax Credit, and the California Solar Initiative’s incentives for customer self-generation .

(Insert image: cost_curves_2002_Slide1.tif)

Nuclear power arguably costs $.03/kWh, only by ignoring large construction capital costs. According to the World Nuclear Association (WNA) report $.03/kWh represents operational costs and waste and decommissioning costs. How they account for waste cost is suspect since the Yucca mountain waste site still has not been approved. If it is approved today it will not be ready till 2017 . Meanwhile thousands of tons of nuclear waste from San Onofre, Diablo Canyon and Humboldt Bay are waiting. What’s not accounted for is construction and financing costs and most importantly, an investor’s required return on capital. According to the Ontario Power Authority’s assessment of the proposed CANDU 6 nuclear power plant, the cost per kWh to the consumer would probably be $.21/kWh when accounting for the required return on capital.

Let’s look at this from a more meaningful perspective. Regarding nuclear, there are four things the consumer needs to consider: 1) How much am I going to pay per kWh?; 2) Will the fuel cycle and generation cycle pollute our environment?; 3) Is it safe?; 4) How does it affect our national security? Each of these issues has a major economic impact.

What am I going to pay per kWh?

Currently, the average PG&E residential electricity rate is over $.16/kWh even though it costs about $.06/kWh for fossil fuel based generation. This should highlight the distinction between what you pay and what it costs to generate one kWh of electricity. Similarly what you will be paying for nuclear will far exceed the reported generation cost of $.03/kWh. As the Ontario Power Authority learned, it could be as high as $.21/kWh. It is expected that uranium 235 will be depleted by 2055 . As that limited resource gets scarce, we will see the cost per kWh rise.

Will the fuel cycle and generation cycle pollute our environment?

Conventional and in situ leaching methods of mining Uranium 235 result in radioactive contamination, lung cancer, respiratory diseases and contamination of ground water. Enrichment of uranium produces toxic hydrogen fluoride gas and large amounts of depleted uranium. Millions of gallons of water which will be radioactively contaminated are required to cool fuel rods. Our other featured articles will cover this more comprehensively.

Is it safe?

Since 1952 there have been about 301 nuclear accidents and 22 nuclear disasters . Maybe that’s why the Price-Anderson Act limits a nuclear corporation’s liability to $10 billion .

How does it affect our national security?

In an age where terrorism is such a major threat, putting in a nuclear power plant only makes Fresno a more attractive terrorist target.

How can we better use $12 billion?

If the Fresno Nuclear Energy Group is able to suppress local resistance, overturn the 30 year old State moratorium on siting new nuclear reactors, and overcome nuclear power’s equally old losing streak in the US investment capital markets, it will still have an uphill financial battle ahead, in the face of more promising alternatives. The proposed nuclear plant will have a capacity of 1600 MW which, assuming a manufacturer-specified 92% plant availability, translates to 12,895 GWh/yr . 92% plant availability is comparable with recent US nuclear plant fleet capacity factors published by the Department of Energy . 12,895 GWh/yr is roughly 4.5% of California’s annual consumption, which was 208,245 GWh in 2005. For comparison, we will take the Fresno Nuclear Energy Group at their word that this plant could be operational as soon as 2015.

Let’s look at what $12 billion can buy us invested in truly clean energy. The investors could put $12 billion into a solar power capital fund, which would be leveraged by Federal tax credits, Federal five-year accelerated depreciation, California Solar Initiative (CSI) incentives, rising utility rates, and rapidly falling solar photovoltaic/solar thermal electric costs.

This solar power capital fund would be available for the development of residential, commercial, agricultural, and public sector solar energy systems, using existing, commercialized technology. Rather than selling hardware, the investors could sell power from customer-sited solar power equipment they own, to Valley energy consumers (via “solar power purchase agreements”), at a guaranteed discount compared to PG&E and Edison (10-25% to guarantee rapid adoption). These solar power purchase agreements are a high yield, low risk return on investment. The combination of Federal and State incentives lead to a short payback period of roughly five years, with an ongoing “solar annuity” from the sale of power.

For the purposes of illustration, $12 billion could be used to develop 1.5 GW of customer-sited solar photovoltaic at $8/watt (CEC AC) in year 2006 prices . The California Solar Initiative will reduce over time, offset by reductions in PV system costs. Here is how the cash flow would look in this solar capital fund :

Initial capital investment: $12 billion

Federal 30% tax credit (first tax year): $3.6 billion

5 yr Accelerated Depreciation (net present value): $4.1 billion

CSI incentive/system cost reduction (five years): $5.4 billion

----------------

Capital investment – Federal/CA incentives: ($1.1 billion)

From this analysis, it is clear that the investors will have more than made their money back (a $1.1 billion profit, in fact), simply considering the Federal and State incentives returned to them in the first five years. For example, the solar capital fund will have been replenished by 2014 if the systems are installed over 2007-2008.

The exciting part: the investors’ solar capital fund would constantly be refilled by incoming Federal and State incentives, ready to roll into the next round of solar expansion. The Solar Energy Industries Association is optimistic that the 110th Congress will deliver an eight year extension of the Federal 30% solar Investment Tax Credit, recently extended through 2008. From 2009-2014, before the proposed nuclear plant could have sold a single kWh, a second 1.5 GW solar photovoltaic network could be financed by income from Federal and State incentives. This second 1.5 GW network will receive substantially less money from the California Solar Initiative than the first, but the planned decline in rebates will be synchronized with a decline in installed system costs.

The first 1.5 GW of solar photovoltaic systems will also be generating an estimated 2,800 GWh/yr (at 5.1 hours/day of noon-equivalent sun, based on Department of Energy data for Fresno) . If the average solar power purchase agreement retail cost of power starts at 10 cents/kWh, and the associated Renewable Energy Certificates (RECs) trade at a conservative two cents/kWh, this first 1.5 GW phase of development will be generating $336 million/year, or over two billion dollars in accumulated profit by 2014. By 2014, before the Fresno Nuclear Energy Group hopes to have an operational reactor, the solar capital fund would have fully manifested all 3 GW of the Governor’s California Solar Initiative, generating 5,600 GWh/yr, with roughly $1 billion/year in annual power and RECs sales. Since the Federal and California incentives for commercial solar development are so generous, they would have also returned the initial $12 billion investment back to the investors, twice over before a nuclear plant could be built.

The same $12 billion could then be used to capitalize a third round of solar power: 3 GW of solar thermal electric for wholesale power purchase agreements. PG&E and Edison have an obligation to by an increasing percentage of their supply from renewable energy resources under the Renewables Portfolio Standard, now 20% qualifying renewables by 2010. Governor Schwarzenegger is backing a goal of 33% qualifying renewables by 2020. Edison, SDG&E, and PG&E have recently signed one to two GW of solar thermal electric power purchase agreements to meet their 2010 goal. An unprecedented amount of renewables capacity will have to be added by 2020, creating significant market opportunities. This 3 GW, at an estimated $4/watt capital cost, would be based on single-axis tracking for higher output/watt capacity, yielding 7,665 GWh/yr.

We are now looking at 6 GW of solar photovoltaic and solar thermal electric systems, all developed on the same timetable as a 1.6 GW nuclear reactor, with substantially better tax effects and return on investment than a nuclear power investment could dream of. In fact, most of their original money is back in the investor’s accounts thanks to the Federal 30% Investment Tax Credit and five year Accelerated Depreciation. The solar investors are producing 5,600 GWh with customer-sited photovoltaic projects, and 7,665 GWh/yr with solar thermal power plants, generating 13,325 Gwh/yr of high value, peak period power. Compare this with 12,895 GWh/yr of baseload nuclear power.

Not only do the solar plants generate more power, they generate more valuable power for the investors. The photovoltaic solar power purchase agreements are retail, at over 10 cents/kWh plus REC prices, and the solar thermal electric are peak period Renewables Portfolio Standard contracts, significantly higher than the contract prices a baseload nuclear plant would command. Solar generates power where and when people need it, and California’s markets now reflect that. The solar investment delivers a higher ongoing electricity production and profit, at a much safer and lower after-tax investment.

How do we know that this solar power purchase agreement model works? It is already being using by a growing list of investors and project developers: GE Commercial Finance, Chevron Energy Systems, Honeywell, PowerLight/DEPFA Bank, MuniMae/MMA Renewable Ventures, HSN Nordbank, Regenesis Power, Nautilus Energy, and Solar Power Partners. In fact, the solar power purchase agreement was the financial structure selected by the Fresno Airport administration for their recent, successful one megawatt solar Request For Proposals. On January 10th of this year, Ted Turner announced that he was breaking in on the solar development action with an investment in DT Solar. California is expected to see over $20 billion of private investment in solar power by 2020, driven by the $3.2 billion California Solar Initiative and Renewables Portfolio Standard. Will the San Joaquin Valley take advantage of our natural solar resources to move into the clean energy future, or will we get stuck in the nuclear past?

In our own back yard, the City of Fresno and the Farm Bureau are adopting solar PV solutions. OK Produce, in downtown Fresno, installed a 231 kW system in January, 2003, and PR Farms, in Clovis, installed a 1.1 MW system in July, 2005. Major corporations like Citigroup, PNC, Bank of America, Toyota, GM, Ford, Honda, Wal-Mart, Target, Home Depot, Lowes and Chipotle, to name a few, are going green . Despite what you have heard, there is a declining use of nuclear throughout the world because of cost, environmental concerns and safety . New nuclear power plant construction around the globe (France, Germany, Sweden, and Japan) have been reduced or eliminated entirely. Seven European plants were shut down in the first two weeks of 2007. Let’s not regress when the rest of the world is moving forward.

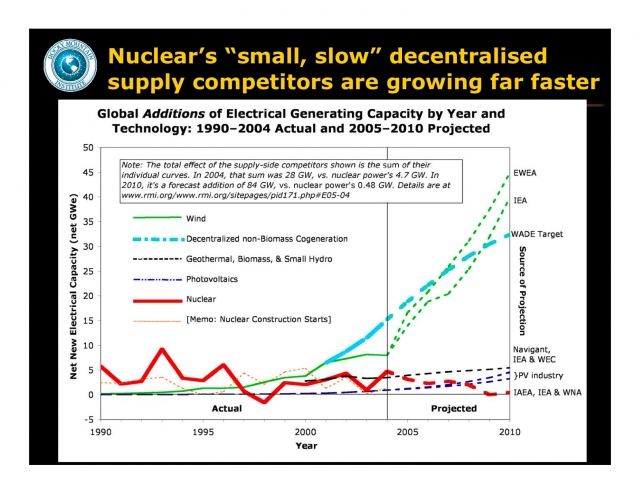

(See image: E06-04_NucPwrEconomics.jpg)

About the authors: Alan Cheah is a retired electrical engineer and software developer. Mark Stout handles Major Accounts for Unlimited Energy Solar Solutions, and is the Sierra Club Tehipite Chapter Air Quaility/Global Warming Co-Chair.

Endnotes:

http://www.taxpayer.net/greenscissors/LearnMore/2003%20Sen%20Nuclear%20Fact%20sht.pdf

http://www.taxpayer.net/greenscissors/LearnMore/2003%20Sen%20Nuclear%20Fact%20sht.pdf

http://www.greens.org/s-r/11/11-09.html

National Renewable Energy Lab (http://www.nrel.gov/analysis/analysis_tools_benefits.html)

http://awea.org/legislative/#PTC

http://www.gosolarcalifornia.ca.gov/csi/tax_credit.html

http://www.uic.com.au/neweconomics.pdf

“Nuclear burial site delayed” Fresno Bee, 14 Aug 2006, page B7

http://www.cleanair.web.net/resource/fs20.pdf

http://www.pge.com/rates/tariffs/ResElecCurrent.xls

http://www.physics.usyd.edu.au/~ned/warming/mills.pdf , page 8

http://archive.greenpeace.org/comms/nukes/chernob/rep02.html

http://www.cbsnews.com/htdocs/nuclear_disasters/framesource.html

http://www.greenscissors.org/energy/price-anderson.htm

http://www.areva-np.com/common/liblocal/docs/Brochure/EPR_US_%20May%202005.pdf, page 55

http://www.eia.doe.gov/emeu/aer/txt/ptb0902.html

http://www.energy.ca.gov/electricity/gross_system_power.html

http://www.sdenergy.org/ContentPage.asp?ContentID=136&SectionID=122&SectionTarget=44

Analysis performed for Fresno area location using the OnGrid Solar Financial Analysis Tool, http://ongrid.net/payback

http://www.seia.org/solarnews.php?id=128

IBID

http://www.cpuc.ca.gov/static/hottopics/1energy/r0404026.htm

http://www.cpuc.ca.gov/_spotlight/051102_renewableenergy.htm

http://www.stirlingenergy.com/breaking_news.htm

http://www.ceiinc.net/Download/Bethel%20Energy%20Solar%20Hybrid%20Project%20Overview%20-%20R3.pdf

http://www.dtsolar.com

Green Revolution, by Frank Geve, Fresno Bee, 17Dec2006, page E1

http://www.brook.edu/fp/cuse/analysis/nuclear.htm

http://www.greens-efa.org/cms/default/dok/164/164228.nuclear_power_plants [at] en.htm

History tells us that projected costs differ vastly from actual costs. Just look at the table below:

PROJECTED VS. ACTUAL COST OF SELECTED NUCLEAR POWER PLANTS

(in billions of dollars)

Unit Megawatts Initial cost estimate Actual cost

Millstone III (Massachusetts and Connecticut) 1,150 .400 3.82

Limerick 1 (Pennsylvania) 1,055 .344 3.80

Wolf Creek (Kansas) 1,055 1.03 2.93

Susquehanna 1 (Pennsylvania) 1,050 .665 2.05

Susquehanna II (Pennsylvania) 1,050 .720 2.05

Source: Public Utility Commissions in the respective states

http://www.21stcenturysciencetech.com/articles/spring01/nuclear_power.html

As you can see, actual costs range from 3 to 11 times projected costs. Nuclear proponents argue that much of the added costs are because of unnecessary environmental and safety regulations, politics and finance issues. Whatever the reason, the reality is that the actual cost would likely exceed $12 billion. If nuclear is such a good investment, why have no nuclear power plant ever been 100% privately funded? In Dick Cheney’s Energy Policy of 2003, Title IV, subtitle B: New Nuclear Plants , it authorizes the Department of Energy to provide 50% of the costs to build new reactors and there are no guidelines regarding interest rates and repayment of these loans. In layman’s terms, we heavily subsidize the building of the plant. We do not share in the profits of the privately owned plant and there is no guarantee our financing will be paid back? If it is so safe, why does provision Title IV, subtitle A: The Price Anderson Act limit the liability of nuclear power plants to $10B. A serious nuclear accident according to Sandia National Laboratories could cost upwards of $300B. Taxpayers will pay the difference.

John Hutson, Chairman of the PUC and President/CEO of the Fresno Nuclear Energy Group LLC, claims nuclear will bring jobs. Undoubtedly, but let’s look at the job creation comparison for different energy sources:

Table 1. Jobs Involved in Producing 1000 Gigawatt-hours of Electricity Per Year

Number of jobs: 10 116 248 542

Energy source: Nuclear fission Coal Solar thermal Wind

This 1993 finding by the Worldwatch Institute should still apply today on a comparative basis. There is no doubt that job creation for renewable energy exceeds that of fossil fuel and nuclear energy. Many states are ignoring the direction of the Federal government and finding more economic benefits in pursuing green energy.

Since 1980 the cost of wind power has declined from $.30 - $.45 per kWh to $.05/kWh . The Federal Production Tax Credit, currently at 1.9 cents/kWh and indexed to inflation , further drives down the cost of wind power to ratepayers, allowing utility power purchase agreements to be signed as low as 3.5 cents. Solar photovoltaic (PV) is about $.20/kWh, and is now reduced with an expanded 30% Federal Investment Tax Credit, and the California Solar Initiative’s incentives for customer self-generation .

(Insert image: cost_curves_2002_Slide1.tif)

Nuclear power arguably costs $.03/kWh, only by ignoring large construction capital costs. According to the World Nuclear Association (WNA) report $.03/kWh represents operational costs and waste and decommissioning costs. How they account for waste cost is suspect since the Yucca mountain waste site still has not been approved. If it is approved today it will not be ready till 2017 . Meanwhile thousands of tons of nuclear waste from San Onofre, Diablo Canyon and Humboldt Bay are waiting. What’s not accounted for is construction and financing costs and most importantly, an investor’s required return on capital. According to the Ontario Power Authority’s assessment of the proposed CANDU 6 nuclear power plant, the cost per kWh to the consumer would probably be $.21/kWh when accounting for the required return on capital.

Let’s look at this from a more meaningful perspective. Regarding nuclear, there are four things the consumer needs to consider: 1) How much am I going to pay per kWh?; 2) Will the fuel cycle and generation cycle pollute our environment?; 3) Is it safe?; 4) How does it affect our national security? Each of these issues has a major economic impact.

What am I going to pay per kWh?

Currently, the average PG&E residential electricity rate is over $.16/kWh even though it costs about $.06/kWh for fossil fuel based generation. This should highlight the distinction between what you pay and what it costs to generate one kWh of electricity. Similarly what you will be paying for nuclear will far exceed the reported generation cost of $.03/kWh. As the Ontario Power Authority learned, it could be as high as $.21/kWh. It is expected that uranium 235 will be depleted by 2055 . As that limited resource gets scarce, we will see the cost per kWh rise.

Will the fuel cycle and generation cycle pollute our environment?

Conventional and in situ leaching methods of mining Uranium 235 result in radioactive contamination, lung cancer, respiratory diseases and contamination of ground water. Enrichment of uranium produces toxic hydrogen fluoride gas and large amounts of depleted uranium. Millions of gallons of water which will be radioactively contaminated are required to cool fuel rods. Our other featured articles will cover this more comprehensively.

Is it safe?

Since 1952 there have been about 301 nuclear accidents and 22 nuclear disasters . Maybe that’s why the Price-Anderson Act limits a nuclear corporation’s liability to $10 billion .

How does it affect our national security?

In an age where terrorism is such a major threat, putting in a nuclear power plant only makes Fresno a more attractive terrorist target.

How can we better use $12 billion?

If the Fresno Nuclear Energy Group is able to suppress local resistance, overturn the 30 year old State moratorium on siting new nuclear reactors, and overcome nuclear power’s equally old losing streak in the US investment capital markets, it will still have an uphill financial battle ahead, in the face of more promising alternatives. The proposed nuclear plant will have a capacity of 1600 MW which, assuming a manufacturer-specified 92% plant availability, translates to 12,895 GWh/yr . 92% plant availability is comparable with recent US nuclear plant fleet capacity factors published by the Department of Energy . 12,895 GWh/yr is roughly 4.5% of California’s annual consumption, which was 208,245 GWh in 2005. For comparison, we will take the Fresno Nuclear Energy Group at their word that this plant could be operational as soon as 2015.

Let’s look at what $12 billion can buy us invested in truly clean energy. The investors could put $12 billion into a solar power capital fund, which would be leveraged by Federal tax credits, Federal five-year accelerated depreciation, California Solar Initiative (CSI) incentives, rising utility rates, and rapidly falling solar photovoltaic/solar thermal electric costs.

This solar power capital fund would be available for the development of residential, commercial, agricultural, and public sector solar energy systems, using existing, commercialized technology. Rather than selling hardware, the investors could sell power from customer-sited solar power equipment they own, to Valley energy consumers (via “solar power purchase agreements”), at a guaranteed discount compared to PG&E and Edison (10-25% to guarantee rapid adoption). These solar power purchase agreements are a high yield, low risk return on investment. The combination of Federal and State incentives lead to a short payback period of roughly five years, with an ongoing “solar annuity” from the sale of power.

For the purposes of illustration, $12 billion could be used to develop 1.5 GW of customer-sited solar photovoltaic at $8/watt (CEC AC) in year 2006 prices . The California Solar Initiative will reduce over time, offset by reductions in PV system costs. Here is how the cash flow would look in this solar capital fund :

Initial capital investment: $12 billion

Federal 30% tax credit (first tax year): $3.6 billion

5 yr Accelerated Depreciation (net present value): $4.1 billion

CSI incentive/system cost reduction (five years): $5.4 billion

----------------

Capital investment – Federal/CA incentives: ($1.1 billion)

From this analysis, it is clear that the investors will have more than made their money back (a $1.1 billion profit, in fact), simply considering the Federal and State incentives returned to them in the first five years. For example, the solar capital fund will have been replenished by 2014 if the systems are installed over 2007-2008.

The exciting part: the investors’ solar capital fund would constantly be refilled by incoming Federal and State incentives, ready to roll into the next round of solar expansion. The Solar Energy Industries Association is optimistic that the 110th Congress will deliver an eight year extension of the Federal 30% solar Investment Tax Credit, recently extended through 2008. From 2009-2014, before the proposed nuclear plant could have sold a single kWh, a second 1.5 GW solar photovoltaic network could be financed by income from Federal and State incentives. This second 1.5 GW network will receive substantially less money from the California Solar Initiative than the first, but the planned decline in rebates will be synchronized with a decline in installed system costs.

The first 1.5 GW of solar photovoltaic systems will also be generating an estimated 2,800 GWh/yr (at 5.1 hours/day of noon-equivalent sun, based on Department of Energy data for Fresno) . If the average solar power purchase agreement retail cost of power starts at 10 cents/kWh, and the associated Renewable Energy Certificates (RECs) trade at a conservative two cents/kWh, this first 1.5 GW phase of development will be generating $336 million/year, or over two billion dollars in accumulated profit by 2014. By 2014, before the Fresno Nuclear Energy Group hopes to have an operational reactor, the solar capital fund would have fully manifested all 3 GW of the Governor’s California Solar Initiative, generating 5,600 GWh/yr, with roughly $1 billion/year in annual power and RECs sales. Since the Federal and California incentives for commercial solar development are so generous, they would have also returned the initial $12 billion investment back to the investors, twice over before a nuclear plant could be built.

The same $12 billion could then be used to capitalize a third round of solar power: 3 GW of solar thermal electric for wholesale power purchase agreements. PG&E and Edison have an obligation to by an increasing percentage of their supply from renewable energy resources under the Renewables Portfolio Standard, now 20% qualifying renewables by 2010. Governor Schwarzenegger is backing a goal of 33% qualifying renewables by 2020. Edison, SDG&E, and PG&E have recently signed one to two GW of solar thermal electric power purchase agreements to meet their 2010 goal. An unprecedented amount of renewables capacity will have to be added by 2020, creating significant market opportunities. This 3 GW, at an estimated $4/watt capital cost, would be based on single-axis tracking for higher output/watt capacity, yielding 7,665 GWh/yr.

We are now looking at 6 GW of solar photovoltaic and solar thermal electric systems, all developed on the same timetable as a 1.6 GW nuclear reactor, with substantially better tax effects and return on investment than a nuclear power investment could dream of. In fact, most of their original money is back in the investor’s accounts thanks to the Federal 30% Investment Tax Credit and five year Accelerated Depreciation. The solar investors are producing 5,600 GWh with customer-sited photovoltaic projects, and 7,665 GWh/yr with solar thermal power plants, generating 13,325 Gwh/yr of high value, peak period power. Compare this with 12,895 GWh/yr of baseload nuclear power.

Not only do the solar plants generate more power, they generate more valuable power for the investors. The photovoltaic solar power purchase agreements are retail, at over 10 cents/kWh plus REC prices, and the solar thermal electric are peak period Renewables Portfolio Standard contracts, significantly higher than the contract prices a baseload nuclear plant would command. Solar generates power where and when people need it, and California’s markets now reflect that. The solar investment delivers a higher ongoing electricity production and profit, at a much safer and lower after-tax investment.

How do we know that this solar power purchase agreement model works? It is already being using by a growing list of investors and project developers: GE Commercial Finance, Chevron Energy Systems, Honeywell, PowerLight/DEPFA Bank, MuniMae/MMA Renewable Ventures, HSN Nordbank, Regenesis Power, Nautilus Energy, and Solar Power Partners. In fact, the solar power purchase agreement was the financial structure selected by the Fresno Airport administration for their recent, successful one megawatt solar Request For Proposals. On January 10th of this year, Ted Turner announced that he was breaking in on the solar development action with an investment in DT Solar. California is expected to see over $20 billion of private investment in solar power by 2020, driven by the $3.2 billion California Solar Initiative and Renewables Portfolio Standard. Will the San Joaquin Valley take advantage of our natural solar resources to move into the clean energy future, or will we get stuck in the nuclear past?

In our own back yard, the City of Fresno and the Farm Bureau are adopting solar PV solutions. OK Produce, in downtown Fresno, installed a 231 kW system in January, 2003, and PR Farms, in Clovis, installed a 1.1 MW system in July, 2005. Major corporations like Citigroup, PNC, Bank of America, Toyota, GM, Ford, Honda, Wal-Mart, Target, Home Depot, Lowes and Chipotle, to name a few, are going green . Despite what you have heard, there is a declining use of nuclear throughout the world because of cost, environmental concerns and safety . New nuclear power plant construction around the globe (France, Germany, Sweden, and Japan) have been reduced or eliminated entirely. Seven European plants were shut down in the first two weeks of 2007. Let’s not regress when the rest of the world is moving forward.

(See image: E06-04_NucPwrEconomics.jpg)

About the authors: Alan Cheah is a retired electrical engineer and software developer. Mark Stout handles Major Accounts for Unlimited Energy Solar Solutions, and is the Sierra Club Tehipite Chapter Air Quaility/Global Warming Co-Chair.

Endnotes:

http://www.taxpayer.net/greenscissors/LearnMore/2003%20Sen%20Nuclear%20Fact%20sht.pdf

http://www.taxpayer.net/greenscissors/LearnMore/2003%20Sen%20Nuclear%20Fact%20sht.pdf

http://www.greens.org/s-r/11/11-09.html

National Renewable Energy Lab (http://www.nrel.gov/analysis/analysis_tools_benefits.html)

http://awea.org/legislative/#PTC

http://www.gosolarcalifornia.ca.gov/csi/tax_credit.html

http://www.uic.com.au/neweconomics.pdf

“Nuclear burial site delayed” Fresno Bee, 14 Aug 2006, page B7

http://www.cleanair.web.net/resource/fs20.pdf

http://www.pge.com/rates/tariffs/ResElecCurrent.xls

http://www.physics.usyd.edu.au/~ned/warming/mills.pdf , page 8

http://archive.greenpeace.org/comms/nukes/chernob/rep02.html

http://www.cbsnews.com/htdocs/nuclear_disasters/framesource.html

http://www.greenscissors.org/energy/price-anderson.htm

http://www.areva-np.com/common/liblocal/docs/Brochure/EPR_US_%20May%202005.pdf, page 55

http://www.eia.doe.gov/emeu/aer/txt/ptb0902.html

http://www.energy.ca.gov/electricity/gross_system_power.html

http://www.sdenergy.org/ContentPage.asp?ContentID=136&SectionID=122&SectionTarget=44

Analysis performed for Fresno area location using the OnGrid Solar Financial Analysis Tool, http://ongrid.net/payback

http://www.seia.org/solarnews.php?id=128

IBID

http://www.cpuc.ca.gov/static/hottopics/1energy/r0404026.htm

http://www.cpuc.ca.gov/_spotlight/051102_renewableenergy.htm

http://www.stirlingenergy.com/breaking_news.htm

http://www.ceiinc.net/Download/Bethel%20Energy%20Solar%20Hybrid%20Project%20Overview%20-%20R3.pdf

http://www.dtsolar.com

Green Revolution, by Frank Geve, Fresno Bee, 17Dec2006, page E1

http://www.brook.edu/fp/cuse/analysis/nuclear.htm

http://www.greens-efa.org/cms/default/dok/164/164228.nuclear_power_plants [at] en.htm

For more information:

http://sierraclub.org/energy

Add Your Comments

Latest Comments

Listed below are the latest comments about this post.

These comments are submitted anonymously by website visitors.

TITLE

AUTHOR

DATE

In the race to stop global warming why best big on the slowest horse?

Fri, Jan 26, 2007 10:06AM

In the race to stop global warming why best big on the slowest horse?

Fri, Jan 26, 2007 10:06AM

Nuclear Power shoudl be apart of our energy portfolio

Wed, Jan 24, 2007 6:14PM

demagoguery, not debate

Tue, Jan 23, 2007 7:42AM

Legislate and Protest Yourselves into another Summer of Rolling Blackouts

Sat, Jan 20, 2007 2:37PM

Californians should all be for nuclear

Sat, Jan 20, 2007 9:36AM

Activist

Sat, Jan 20, 2007 1:27AM

Make your own decision--bring solar to your roof

Fri, Jan 19, 2007 10:14PM

Speaking of Diablo Canyon

Fri, Jan 19, 2007 2:47PM

One more thing about the cost benefit of nuclear power

Thu, Jan 18, 2007 11:39PM

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network