From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

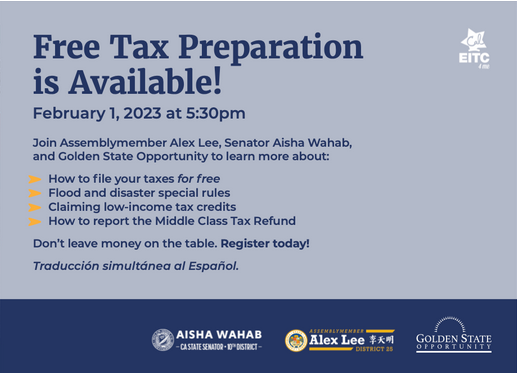

Learn about Free Tax Prep Help, Flood & Disaster Tax Rules, Low-Income Credits & more

Date:

Wednesday, February 01, 2023

Time:

5:30 PM

-

6:30 PM

Event Type:

Class/Workshop

Organizer/Author:

Golden State Opportunity

Location Details:

Online via Zoom (FREE)

Workshop is for both individuals and businesses

Workshop is for both individuals and businesses

RSVP: https://caasm.zoom.us/webinar/register/WN_2UyKsbseT6yJ324Aw3W6QA

Join Golden State Opportunity to learn more about:

1. How to file taxes for free

2. Flood and disaster special tax rules

3. Claiming low-income tax credits

4. How to report the Middle-Class Tax Refund on your tax return

We'll be covering things including filing your taxes for FREE, tax extensions, and flood and disaster special rules including deduction and disaster loss. Residents and businesses in both Santa Clara County and Alameda County affected by the severe winter storms are eligible.

Spanish interpretation will also be available.

ABOUT: Golden State Opportunity

GSO non-profit is a leading statewide advocacy organization working to end poverty and ensure everyone can meet life’s basic needs and invest in their future. GSO’s leadership and advocacy for low-income workers led California to establish the Young Child Tax Credit and expand CalEITC eligibility to include anyone 18+ and all ITIN holders, making CalEITC one of the strongest and most inclusive EITC programs in the country.

Join Golden State Opportunity to learn more about:

1. How to file taxes for free

2. Flood and disaster special tax rules

3. Claiming low-income tax credits

4. How to report the Middle-Class Tax Refund on your tax return

We'll be covering things including filing your taxes for FREE, tax extensions, and flood and disaster special rules including deduction and disaster loss. Residents and businesses in both Santa Clara County and Alameda County affected by the severe winter storms are eligible.

Spanish interpretation will also be available.

ABOUT: Golden State Opportunity

GSO non-profit is a leading statewide advocacy organization working to end poverty and ensure everyone can meet life’s basic needs and invest in their future. GSO’s leadership and advocacy for low-income workers led California to establish the Young Child Tax Credit and expand CalEITC eligibility to include anyone 18+ and all ITIN holders, making CalEITC one of the strongest and most inclusive EITC programs in the country.

Added to the calendar on Sun, Jan 29, 2023 9:10AM

Add Your Comments

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network