From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

The Weiner Goes Crazy At Jane Kim Meeting In SF-Deregulation vs Regulation of Capitalism

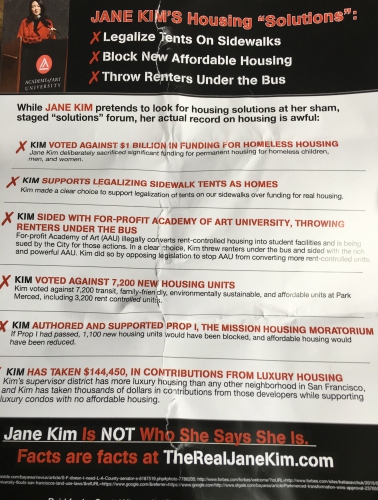

SF supervisor Scott Weiner who is running for State Senate organized a protest at a meeting of his opponent Jane Kim He put up tents in front of Mission High where the meeting took place and also charged that Kim was being supported more by developers than he was.

San Francisco Supervisor Scott Weiner who is running for the California State Senate organized his supporters on August 30, 2016 at Mission High to picket and protest a "town hall" meeting called by Supervisor Jane Kim who is also running for the State Senate. They placed tents on the sidewalks and claimed that Kim was getting more financial support from developers than Scott Weiner and she wanted the tents to stay up in San Francisco. Some of his supporters called for deregulation of the housing market and also supported Jerry Brown's change of zoning laws to limit controls by local communities. One said there was not a problem with evictions in San Francisco and the eviction law was working good. Weiner had previously blocked a SF supervisors resolution opposing Governor Brown's proposal.

One of Jane Kim's speakers at the meeting former mayor Antonio Villaraegosa said he did not know about Governor Brown's proposed legislation. He also has attacked Los Angeles teacher union UTLA and supported the proposal of billionaire Eli Broad to privatize LA schools through more charters in Los Angeles.

Kim has also supported charters in San Francisco and says they should be for the students doing best. Her statement on charters and privatization that she gave to AFT 2121 was removed from their website by the AFT 212 political director Alisa Messer who said it was being used politically by outsiders.

Former LA Mayor Antonio Villaraigosa attacked UTLA Teachers for blocking union reforms

http://blogs.sacbee.com/capitolalertlatest/2010/12/la-mayor-antonio-villaraigosa.html

Mayor Villaraigosa comes down hard on UTLA leadership

http://www.scpr.org/programs/madeleine-brand/2010/12/09/17097/villaraigosa-comes-down-hard-on-teacher-union-lead/

http://educationnext.org/palace-revolt-in-los-angeles/

http://www.counterpunch.org/2016/06/03/has-sanders-betrayed-his-revolution-by-endorsing-jane-kim/

http://www.sfexaminer.com/gov-browns-housing-plan-riling-politics-sf-beyond/

Production of Labor Video Project

http://www.laborvideo.org

One of Jane Kim's speakers at the meeting former mayor Antonio Villaraegosa said he did not know about Governor Brown's proposed legislation. He also has attacked Los Angeles teacher union UTLA and supported the proposal of billionaire Eli Broad to privatize LA schools through more charters in Los Angeles.

Kim has also supported charters in San Francisco and says they should be for the students doing best. Her statement on charters and privatization that she gave to AFT 2121 was removed from their website by the AFT 212 political director Alisa Messer who said it was being used politically by outsiders.

Former LA Mayor Antonio Villaraigosa attacked UTLA Teachers for blocking union reforms

http://blogs.sacbee.com/capitolalertlatest/2010/12/la-mayor-antonio-villaraigosa.html

Mayor Villaraigosa comes down hard on UTLA leadership

http://www.scpr.org/programs/madeleine-brand/2010/12/09/17097/villaraigosa-comes-down-hard-on-teacher-union-lead/

http://educationnext.org/palace-revolt-in-los-angeles/

http://www.counterpunch.org/2016/06/03/has-sanders-betrayed-his-revolution-by-endorsing-jane-kim/

http://www.sfexaminer.com/gov-browns-housing-plan-riling-politics-sf-beyond/

Production of Labor Video Project

http://www.laborvideo.org

For more information:

https://www.youtube.com/watch?v=o_1xxLF35fw

Add Your Comments

Comments

(Hide Comments)

While we watch the farce of 2 Democrats pretending to be adversaries in the state senate race and its lesson that all Democrats should be avoided, we should also be concerned about Proposition V, the second regressive grocery tax on the ballot, put there this time by

Supervisors Scott Wiener, Mark Farrell, Eric Mar and Malia Cohen, the Four Horsemen & women of the Apocalypse, all Democrats, and endorsed by the utterly reactionary and criminal Democratic Party machine of San Francisco, as they did in 2014.

In 2014, the cover for this slush fund was to contribute money to certain city departments, which required the proponents of this grocery tax to obtain 66% of the vote, and therefore it lost with 54% of the vote supporting it. The current regressive tax on the workingclass, the 80% of us who sell our labor for less than $80,000 a year, goes directly into the General Fund, making it clearly a slush fund to support political cronies, and since no beneficiary is designated, it only needs 50% plus 1 vote to pass or fail. Then, as now, the slush fund is, by law, a tax on the distributors of soda pop, not directly on the retailers, and the retailers, such as grocery stores and restaurants have the option to pass their excess costs on to the consumer by raising prices on anything, not necessarily soda pop. A sales tax that is either direct or in this case, indirect, is regressive because the workingclass spends a far greater portion of our income on food and other necessities than do the rich.

This slush fund tax on the distributors of soda pop passed in Berkeley so we can see how the retailers make the consumer pay: Soda pop prices are the same but food prices have increased! See “Barnidge: If Berkeley shoppers don't have to pay the soda tax, does it really exist?” by Tom Barnidge, 5/22/15, Contra Costa Times at

http://www.mercurynews.com/columns/ci_28170149/barnidge-if-berkeley-shoppers-dont-have-pay-soda

For more media reports, see:

http://www.donttaxourgroceries.com/news.aspx

You can read the text of Proposition V, an outrageous and unconscionable increase in the cost of living in one of the most expensive cities in the US, San Francisco, by promoting a criminal slush fund for political cronies at:

http://sfgov.org/elections/sites/default/files/Documents/candidates/Sugary%20Legal%20Text.pdf

You can also access this text by going to:

http://sfgov.org/elections/local-ballot-measure-status,

then to

http://sfgov.org/elections/file/3941

Election Day is November 8, 2016, and in California, you can vote by mail starting October 11, 2016 if you are registered at your current address. If you have not received the 3 excellent slick mailers opposing this grocery tax, arriving in our mail boxes on August 24, 26 and 30, 2016, then you are probably not registered at your current address and need to do so immediately. You can go online at https://covr.sos.ca.gov/?language=en-US or better yet, you can go to your County Registrar, which you may find at http://www.sos.ca.gov/elections/voting-resources/county-elections-offices/ In San Francisco, the Registrar of Voters is at City Hall, Basement, Van Ness side between McAllister and Grove, open 8 am to 5 p.m. When you register to vote, be sure to also sign up to permanent vote by mail voter so you can vote in the comfort of your home starting 29 days before election day and so you never forget to vote!

While the Democratic Party has again demonstrated its open contempt for the workingclass, Peace & Freedom Party always opposes all sales taxes since they are regressive and the Green Party remains neutral on this grocery tax as they were in 2014. Clearly opposing Proposition V are the San Francisco Tenants Union and the Harvey Milk LGBT Club, two important mobilizers of voters. Hopefully these slick mailers which we expect to brighten our mailboxes weekly will inspire the San Francisco Labor Council to oppose this grocery tax since currently they have no position. In 2014, the Teamsters opposed this grocery tax. You can watch the contributors at http://www.sfethics.org/ethics/2016/06/campaign-finance-dashboards-june-7-2016-and-november-8-2016-elections.html

While some might complain that the American Beverage Association, which represents all the non-alcoholic beverage companies, is the primary financial supporter of the opposition at this point, others point out that they had better pay to stop this increase in our food budget as San Francisco is already too expensive for the entire workingclass. Only those of us who are living in rent controlled apartments or bought an old home decades ago can stay here and no new members of the workingclass can move to San Francisco, including office workers, janitors, restaurant workers, hotel workers, teachers, nurses, most medical workers who are not doctors, truck drivers, construction workers, and everybody else who sells our labor for less than $80,000 a year, the workingclass in this country. We certainly cannot afford to buy a condominium or a home here, which range from $800,000 to millions of dollars, requiring a minimum income of $120,000 a year for a small condominium.

We have waited 36 years, for the local Democratic Party to house the homeless. Since they have been at City Hall since 1964, they have had plenty of time to obtain public financing to build sufficient housing for the workingclass, including the homeless, and not only have not done so, but clearly with the constant promotion of a regressive grocery tax to build a slush fund for cronies, have absolutely no intention of doing so unless we demand affordable housing for the workingclass now! We could and should demand that the City transfer the $577 million given to the police department to all housing and social services departments since the police are not social workers; they are simply armed thugs whose sole purpose is to terrorize the workingclass. We should also demand the City tax the 147,400 millionaires and 18 billionaires living in San Francisco by going to the State Legislature, where the Assembly and Senate have a supermajority Democrats and demanding that they increase the progressive income tax on the 750,000 millionaire households in California, and demand that the Democrat Governor Jerry Brown support this increase on the income of the rich to pay for affordable housing for the workingclass now!

Supervisors Scott Wiener, Mark Farrell, Eric Mar and Malia Cohen, the Four Horsemen & women of the Apocalypse, all Democrats, and endorsed by the utterly reactionary and criminal Democratic Party machine of San Francisco, as they did in 2014.

In 2014, the cover for this slush fund was to contribute money to certain city departments, which required the proponents of this grocery tax to obtain 66% of the vote, and therefore it lost with 54% of the vote supporting it. The current regressive tax on the workingclass, the 80% of us who sell our labor for less than $80,000 a year, goes directly into the General Fund, making it clearly a slush fund to support political cronies, and since no beneficiary is designated, it only needs 50% plus 1 vote to pass or fail. Then, as now, the slush fund is, by law, a tax on the distributors of soda pop, not directly on the retailers, and the retailers, such as grocery stores and restaurants have the option to pass their excess costs on to the consumer by raising prices on anything, not necessarily soda pop. A sales tax that is either direct or in this case, indirect, is regressive because the workingclass spends a far greater portion of our income on food and other necessities than do the rich.

This slush fund tax on the distributors of soda pop passed in Berkeley so we can see how the retailers make the consumer pay: Soda pop prices are the same but food prices have increased! See “Barnidge: If Berkeley shoppers don't have to pay the soda tax, does it really exist?” by Tom Barnidge, 5/22/15, Contra Costa Times at

http://www.mercurynews.com/columns/ci_28170149/barnidge-if-berkeley-shoppers-dont-have-pay-soda

For more media reports, see:

http://www.donttaxourgroceries.com/news.aspx

You can read the text of Proposition V, an outrageous and unconscionable increase in the cost of living in one of the most expensive cities in the US, San Francisco, by promoting a criminal slush fund for political cronies at:

http://sfgov.org/elections/sites/default/files/Documents/candidates/Sugary%20Legal%20Text.pdf

You can also access this text by going to:

http://sfgov.org/elections/local-ballot-measure-status,

then to

http://sfgov.org/elections/file/3941

Election Day is November 8, 2016, and in California, you can vote by mail starting October 11, 2016 if you are registered at your current address. If you have not received the 3 excellent slick mailers opposing this grocery tax, arriving in our mail boxes on August 24, 26 and 30, 2016, then you are probably not registered at your current address and need to do so immediately. You can go online at https://covr.sos.ca.gov/?language=en-US or better yet, you can go to your County Registrar, which you may find at http://www.sos.ca.gov/elections/voting-resources/county-elections-offices/ In San Francisco, the Registrar of Voters is at City Hall, Basement, Van Ness side between McAllister and Grove, open 8 am to 5 p.m. When you register to vote, be sure to also sign up to permanent vote by mail voter so you can vote in the comfort of your home starting 29 days before election day and so you never forget to vote!

While the Democratic Party has again demonstrated its open contempt for the workingclass, Peace & Freedom Party always opposes all sales taxes since they are regressive and the Green Party remains neutral on this grocery tax as they were in 2014. Clearly opposing Proposition V are the San Francisco Tenants Union and the Harvey Milk LGBT Club, two important mobilizers of voters. Hopefully these slick mailers which we expect to brighten our mailboxes weekly will inspire the San Francisco Labor Council to oppose this grocery tax since currently they have no position. In 2014, the Teamsters opposed this grocery tax. You can watch the contributors at http://www.sfethics.org/ethics/2016/06/campaign-finance-dashboards-june-7-2016-and-november-8-2016-elections.html

While some might complain that the American Beverage Association, which represents all the non-alcoholic beverage companies, is the primary financial supporter of the opposition at this point, others point out that they had better pay to stop this increase in our food budget as San Francisco is already too expensive for the entire workingclass. Only those of us who are living in rent controlled apartments or bought an old home decades ago can stay here and no new members of the workingclass can move to San Francisco, including office workers, janitors, restaurant workers, hotel workers, teachers, nurses, most medical workers who are not doctors, truck drivers, construction workers, and everybody else who sells our labor for less than $80,000 a year, the workingclass in this country. We certainly cannot afford to buy a condominium or a home here, which range from $800,000 to millions of dollars, requiring a minimum income of $120,000 a year for a small condominium.

We have waited 36 years, for the local Democratic Party to house the homeless. Since they have been at City Hall since 1964, they have had plenty of time to obtain public financing to build sufficient housing for the workingclass, including the homeless, and not only have not done so, but clearly with the constant promotion of a regressive grocery tax to build a slush fund for cronies, have absolutely no intention of doing so unless we demand affordable housing for the workingclass now! We could and should demand that the City transfer the $577 million given to the police department to all housing and social services departments since the police are not social workers; they are simply armed thugs whose sole purpose is to terrorize the workingclass. We should also demand the City tax the 147,400 millionaires and 18 billionaires living in San Francisco by going to the State Legislature, where the Assembly and Senate have a supermajority Democrats and demanding that they increase the progressive income tax on the 750,000 millionaire households in California, and demand that the Democrat Governor Jerry Brown support this increase on the income of the rich to pay for affordable housing for the workingclass now!

A Soda Tax Would Hurt Philly’s Low-Income Families

In an exclusive op-ed, the Vermont senator explains why he doesn’t support Mayor Kenney’s proposed soda tax.

http://www.phillymag.com/citified/2016/04/24/bernie-sanders-soda-tax-op-ed/

BY BERNIE SANDERS | APRIL 24, 2016 AT 5:00 PM

image: http://cdn.phillymag.com/wp-content/uploads/2016/04/bernie-sanders-portrait-02-1.jpg

Photo courtesy of the Bernie Sanders campaign

(Editor’s note: This is an opinion column from guest writer Bernie Sanders. Sanders is a Democratic presidential candidate and U.S. senator representing Vermont. Pennsylvania’s primary is Tuesday.)

I applaud Philadelphia Mayor Jim Kenney for introducing a plan to provide universal preschool for all of his city’s 4-year olds. I strongly share the goal of ensuring that every family has access to high-quality, affordable preschool and childcare.

But I do not support Mayor Kenney’s plan to pay for this program with a regressive grocery tax that would disproportionately affect low-income and middle-class Americans.

I was especially surprised to hear Hillary Clinton say that she is “very supportive” of this proposal. Secretary Clinton has vowed not to raises taxes on anyone making less than $250,000 per year. For reasons that are not clear, she has chosen to abandon her pledge by embracing a tax that targets the poor and the middle class while going easy on the wealthy. That approach is wrong for Philadelphia, and wrong for the country.

Mayor Kenney wants to raise $400 million from a tax on juice boxes, soft drinks, teas, flavored coffee and other sweetened drinks. His proposal would raise the price of a $1.00 soft drink to $1.24. That will hit many Philadelphians hard, especially the more than 185,000 people in the city who are trying to scrape by on less than $12,000 a year. He twice opposed the same tax idea. He was right then. He’s wrong now.

It would make much more sense to finance universal preschool in Philadelphia by raising taxes on its wealthiest residents who currently benefit from flat state and city tax rates. What’s more, national tax rates for wealthy Americans and corporations are much lower than they were under President Ronald Reagan. For example, the Commerce Department and other data found that corporations paid an effective tax of 31.7 percent on average during the Reagan years, but only 22.8 percent on average under President Barack Obama.

That means more than $166 billion per year in revenue has been lost because of the influence of corporate lobbyists and campaign contributions. Not only could that money be used to make sure that every 4-year old in this country had access to a high-quality preschool, it could also provide the resources necessary to provide universal child care and preschool to every infant and toddler in America with billions to spare for other urgently needed programs.

Mayor Kenney deserves praise for emphasizing the importance of universal pre-kindergarten. But at a time of massive income and wealth inequality, it should be the people on top who see an increase in their taxes, not low-income and working people.

Read more at http://www.phillymag.com/citified/2016/04/24/bernie-sanders-soda-tax-op-ed/#e4rtL4EtFfOM5Mhu.99

In an exclusive op-ed, the Vermont senator explains why he doesn’t support Mayor Kenney’s proposed soda tax.

http://www.phillymag.com/citified/2016/04/24/bernie-sanders-soda-tax-op-ed/

BY BERNIE SANDERS | APRIL 24, 2016 AT 5:00 PM

image: http://cdn.phillymag.com/wp-content/uploads/2016/04/bernie-sanders-portrait-02-1.jpg

Photo courtesy of the Bernie Sanders campaign

(Editor’s note: This is an opinion column from guest writer Bernie Sanders. Sanders is a Democratic presidential candidate and U.S. senator representing Vermont. Pennsylvania’s primary is Tuesday.)

I applaud Philadelphia Mayor Jim Kenney for introducing a plan to provide universal preschool for all of his city’s 4-year olds. I strongly share the goal of ensuring that every family has access to high-quality, affordable preschool and childcare.

But I do not support Mayor Kenney’s plan to pay for this program with a regressive grocery tax that would disproportionately affect low-income and middle-class Americans.

I was especially surprised to hear Hillary Clinton say that she is “very supportive” of this proposal. Secretary Clinton has vowed not to raises taxes on anyone making less than $250,000 per year. For reasons that are not clear, she has chosen to abandon her pledge by embracing a tax that targets the poor and the middle class while going easy on the wealthy. That approach is wrong for Philadelphia, and wrong for the country.

Mayor Kenney wants to raise $400 million from a tax on juice boxes, soft drinks, teas, flavored coffee and other sweetened drinks. His proposal would raise the price of a $1.00 soft drink to $1.24. That will hit many Philadelphians hard, especially the more than 185,000 people in the city who are trying to scrape by on less than $12,000 a year. He twice opposed the same tax idea. He was right then. He’s wrong now.

It would make much more sense to finance universal preschool in Philadelphia by raising taxes on its wealthiest residents who currently benefit from flat state and city tax rates. What’s more, national tax rates for wealthy Americans and corporations are much lower than they were under President Ronald Reagan. For example, the Commerce Department and other data found that corporations paid an effective tax of 31.7 percent on average during the Reagan years, but only 22.8 percent on average under President Barack Obama.

That means more than $166 billion per year in revenue has been lost because of the influence of corporate lobbyists and campaign contributions. Not only could that money be used to make sure that every 4-year old in this country had access to a high-quality preschool, it could also provide the resources necessary to provide universal child care and preschool to every infant and toddler in America with billions to spare for other urgently needed programs.

Mayor Kenney deserves praise for emphasizing the importance of universal pre-kindergarten. But at a time of massive income and wealth inequality, it should be the people on top who see an increase in their taxes, not low-income and working people.

Read more at http://www.phillymag.com/citified/2016/04/24/bernie-sanders-soda-tax-op-ed/#e4rtL4EtFfOM5Mhu.99

For more information:

http://www.phillymag.com/citified/2016/04/...

Soda Tax Is Regressive

Fact-checking Bernie Sanders’ claim that Jim Kenney’s soda tax is regressive

http://www.politifact.com/pennsylvania/statements/2016/apr/25/bernie-s/fact-checking-bernie-sanders-claim-jim-kenneys-sod/

By Mark Dent on Monday, April 25th, 2016 at 1:02 p.m.

Jim Kenney’s proposed soda tax went national last week.

Hillary Clinton led off what became a back-and-forth political battle by voicing her support for the tax at a forum in Philadelphia. Bernie Sanders chimed in later to call the tax regressive.

Kenney fired back in an editorial on Huffington Post that his proposal, which would levy a three cent per ounce tax on distributors, was a "corporate tax" and said Sanders was siding with beverage corporations. Then Sanders responded with an editorial of his own, in Philly Mag. He basically gave an elongated version of what he said earlier in the week, which was, "A tax on soda and juice drinks would disproportionately increase taxes on low-income families in Philadelphia."

Is Sanders correct? Or was this political grandstanding?

Berkeley, Calif., remains the lone American city to enact a sugary drink tax. It taxes the distributors of sodas and similar beverages like sports drinks 1 cent per ounce. Studies have shown some of the cost of tax has been passed on to consumers. A Cornell study found about 25 percent of it was passed on, and a University of California-Berkeley study found the amount to be between about 50 to 70 percent, depending on the type of beverage. The prices of soft drinks were more likely to go up at supermarkets than chain drug stores.

Carl Davis, the research director at the Institute on Taxation and Economic Policy, told Billy Penn last month soda taxes like the one proposed by Philadelphia are "imperfect:" "The first thing you realize is that it is regressive. It’s going to hit lower and more moderate income families more heavily than higher-income families."

William Shughart, a Utah State University professor and sin tax expert, explained taxes like the one proposed by Kenney disproportionately affect lower income residents because a greater amount of their income is used on food and drinks.

Warren Gunnels, senior policy advisor for Sanders, said in an email, "It would make much more sense to finance universal pre-school in Philadelphia by raising taxes on its wealthiest residents, who currently benefit from flat state and city tax rates. Right now wealthy Philadelphians pay state income tax of 3.07 percent, an unemployment tax of 0.07 percent, and a city income tax of 3.92 percent. That’s a total state and local tax burden of 7.06 percent. By contrast, New York City’s wealthiest residents pay a top rate of 12.6 percent."

Such a plan would be easier said than done, according to Kenney’s administration. "Because of the uniformity clause, it’s constitutionally impermissible right now in Pennsylvania to raise the income tax rate only for wealthy individuals," said Lauren Hitt, Kenney’s communications director. "The Republican controlled state legislature would have to change the constitution and we’re not holding our breath on that one. Our kids need Pre-K now."

Kenney has said the tax is not regressive because he believes the money will stay in the neighborhoods. His finance director, Rob Dubow, said most consumers of sugary drinks are in poor neighborhoods. When Dubow suggested distributors would absorb some of the tax, City Council president Darrell Clarke responded, "Fundamentally, I don’t believe that."

Our ruling

Sanders said Kenney’s proposed soda tax would disproportionately increase taxes for low income families. In the only other instance of a soda tax in the United States, studies have shown somewhere between 25 and 70 percent of the cost of the tax gets passed to consumers. Tax experts say if this tax reaches the consumer level it would affect low income residents to a greater extent.

We rule the claim True.

Fact-checking Bernie Sanders’ claim that Jim Kenney’s soda tax is regressive

http://www.politifact.com/pennsylvania/statements/2016/apr/25/bernie-s/fact-checking-bernie-sanders-claim-jim-kenneys-sod/

By Mark Dent on Monday, April 25th, 2016 at 1:02 p.m.

Jim Kenney’s proposed soda tax went national last week.

Hillary Clinton led off what became a back-and-forth political battle by voicing her support for the tax at a forum in Philadelphia. Bernie Sanders chimed in later to call the tax regressive.

Kenney fired back in an editorial on Huffington Post that his proposal, which would levy a three cent per ounce tax on distributors, was a "corporate tax" and said Sanders was siding with beverage corporations. Then Sanders responded with an editorial of his own, in Philly Mag. He basically gave an elongated version of what he said earlier in the week, which was, "A tax on soda and juice drinks would disproportionately increase taxes on low-income families in Philadelphia."

Is Sanders correct? Or was this political grandstanding?

Berkeley, Calif., remains the lone American city to enact a sugary drink tax. It taxes the distributors of sodas and similar beverages like sports drinks 1 cent per ounce. Studies have shown some of the cost of tax has been passed on to consumers. A Cornell study found about 25 percent of it was passed on, and a University of California-Berkeley study found the amount to be between about 50 to 70 percent, depending on the type of beverage. The prices of soft drinks were more likely to go up at supermarkets than chain drug stores.

Carl Davis, the research director at the Institute on Taxation and Economic Policy, told Billy Penn last month soda taxes like the one proposed by Philadelphia are "imperfect:" "The first thing you realize is that it is regressive. It’s going to hit lower and more moderate income families more heavily than higher-income families."

William Shughart, a Utah State University professor and sin tax expert, explained taxes like the one proposed by Kenney disproportionately affect lower income residents because a greater amount of their income is used on food and drinks.

Warren Gunnels, senior policy advisor for Sanders, said in an email, "It would make much more sense to finance universal pre-school in Philadelphia by raising taxes on its wealthiest residents, who currently benefit from flat state and city tax rates. Right now wealthy Philadelphians pay state income tax of 3.07 percent, an unemployment tax of 0.07 percent, and a city income tax of 3.92 percent. That’s a total state and local tax burden of 7.06 percent. By contrast, New York City’s wealthiest residents pay a top rate of 12.6 percent."

Such a plan would be easier said than done, according to Kenney’s administration. "Because of the uniformity clause, it’s constitutionally impermissible right now in Pennsylvania to raise the income tax rate only for wealthy individuals," said Lauren Hitt, Kenney’s communications director. "The Republican controlled state legislature would have to change the constitution and we’re not holding our breath on that one. Our kids need Pre-K now."

Kenney has said the tax is not regressive because he believes the money will stay in the neighborhoods. His finance director, Rob Dubow, said most consumers of sugary drinks are in poor neighborhoods. When Dubow suggested distributors would absorb some of the tax, City Council president Darrell Clarke responded, "Fundamentally, I don’t believe that."

Our ruling

Sanders said Kenney’s proposed soda tax would disproportionately increase taxes for low income families. In the only other instance of a soda tax in the United States, studies have shown somewhere between 25 and 70 percent of the cost of the tax gets passed to consumers. Tax experts say if this tax reaches the consumer level it would affect low income residents to a greater extent.

We rule the claim True.

For more information:

http://www.politifact.com/pennsylvania/sta...

A tax on soda drinks is basically a sin tax, just like those on booze and cigarettes. The guiding principle behind such taxes is that the higher the price the fewer the number of people partaking. It's been highly successful in reducing the number of smokers.

Please read my initial comment above. It refers to an article commenting on Berkeley's tax on the distributors of soda, which was NOT passed on to the consumer in soda prices, but in HIGHER FOOD PRICES, and that is exactly what will happen in San Francisco. The reason soda prices are NOT increased is because soda pop brings people into the store or in the case of restaurants, is the cheap beverage that goes with the meal. Store and restaurant owners (distributors) have to raise prices on food to cover their increased costs unless they are large corporations like Safeway and can absorb increased costs better.

Please read the link to Prop V above. Prop V states, on page 7, Section 553: Imposition of Tax: Deposit of Proceeds,

Section A: "...the City imposes a Sugary Drinks DISTRIBUTOR Tax, which shall be a GENERAL EXCISE TAX, on the DISTRIBUTOR making the initial Distribution of a Bottled Sugar-Sweetened Beverage, Syrup or Powder in the City."

Section B states: “The Tax shall be calculated as follows:

(1) One cent per fluid ounce of a Bottled Sugar-Sweetened Beverage upon the INITIAL Distribution within the City of the Bottled Sugar-Sweetened Beverage;”

Section C states: The Tax is a general tax. Proceeds of the Tax are to be deposited in the GENERAL FUND.”

You will see on the 8/30/16 slick mailer against this Grocery Tax, featuring Danielle Reed Reese of Queen’s Louisiana Po-Boy Café, under GROCERY TAX FACTS, it states:

“The State Board of Equalization warned local government officials of potential violations of state tax law should a sales tax be placed on specific items, like beverages. THAT IS WHY THIS IS NOT A TAX ON BEVERAGES; IT IS A TAX ON DISTRIBUTORS, who include the small business owners who run your local grocery store or restaurant.”

AGAIN, this is NOT a tax on beverages; it is a TAX ON DISTRIBUTORS, the retailers, who have small profit margins and have no choice but to charge the consumers more for the food we buy. You can be sure Safeway will try to charge us more for food too; their primary goal is also maximization of profit. Although they can absorb more costs, they try to avoid doing so.

On the 8/24/16 slick mailer against this Grocery Tax, under GROCERY TAX FACTS, it states what we all read in the San Francisco Examiner: The 4 Horsemen/women of the Apocalypse cited above proudly state this is a REGRESSIVE TAX, meaning it will adversely harm the workingclass. The GROCERY TAX FACTS on the 8/26/16 slick mailer quotes the US Bureau of Labor Statistics, stating:

“The Grocery Tax is a regressive tax that hurts low-income families the most since groceries are a bigger percentage of their budget.”

As Prop V states, the millions of dollars collected from the store owners and restaurants will go directly into the GENERAL FUND, which is to say this is a slush fund. This is outright criminality on the part of the San Francisco Democratic Party and its 4 reactionary Supervisors who signed to put this on the ballot. IT DOES NOT MATTER WHAT YOU EAT, YOU WILL PAY THIS TAX IN HIGHER FOOD PRICES.

Please read the link to Prop V above. Prop V states, on page 7, Section 553: Imposition of Tax: Deposit of Proceeds,

Section A: "...the City imposes a Sugary Drinks DISTRIBUTOR Tax, which shall be a GENERAL EXCISE TAX, on the DISTRIBUTOR making the initial Distribution of a Bottled Sugar-Sweetened Beverage, Syrup or Powder in the City."

Section B states: “The Tax shall be calculated as follows:

(1) One cent per fluid ounce of a Bottled Sugar-Sweetened Beverage upon the INITIAL Distribution within the City of the Bottled Sugar-Sweetened Beverage;”

Section C states: The Tax is a general tax. Proceeds of the Tax are to be deposited in the GENERAL FUND.”

You will see on the 8/30/16 slick mailer against this Grocery Tax, featuring Danielle Reed Reese of Queen’s Louisiana Po-Boy Café, under GROCERY TAX FACTS, it states:

“The State Board of Equalization warned local government officials of potential violations of state tax law should a sales tax be placed on specific items, like beverages. THAT IS WHY THIS IS NOT A TAX ON BEVERAGES; IT IS A TAX ON DISTRIBUTORS, who include the small business owners who run your local grocery store or restaurant.”

AGAIN, this is NOT a tax on beverages; it is a TAX ON DISTRIBUTORS, the retailers, who have small profit margins and have no choice but to charge the consumers more for the food we buy. You can be sure Safeway will try to charge us more for food too; their primary goal is also maximization of profit. Although they can absorb more costs, they try to avoid doing so.

On the 8/24/16 slick mailer against this Grocery Tax, under GROCERY TAX FACTS, it states what we all read in the San Francisco Examiner: The 4 Horsemen/women of the Apocalypse cited above proudly state this is a REGRESSIVE TAX, meaning it will adversely harm the workingclass. The GROCERY TAX FACTS on the 8/26/16 slick mailer quotes the US Bureau of Labor Statistics, stating:

“The Grocery Tax is a regressive tax that hurts low-income families the most since groceries are a bigger percentage of their budget.”

As Prop V states, the millions of dollars collected from the store owners and restaurants will go directly into the GENERAL FUND, which is to say this is a slush fund. This is outright criminality on the part of the San Francisco Democratic Party and its 4 reactionary Supervisors who signed to put this on the ballot. IT DOES NOT MATTER WHAT YOU EAT, YOU WILL PAY THIS TAX IN HIGHER FOOD PRICES.

Any tax on soda, whether on the item or its distributor, is a good tax as far as I'm concerned.

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network