From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

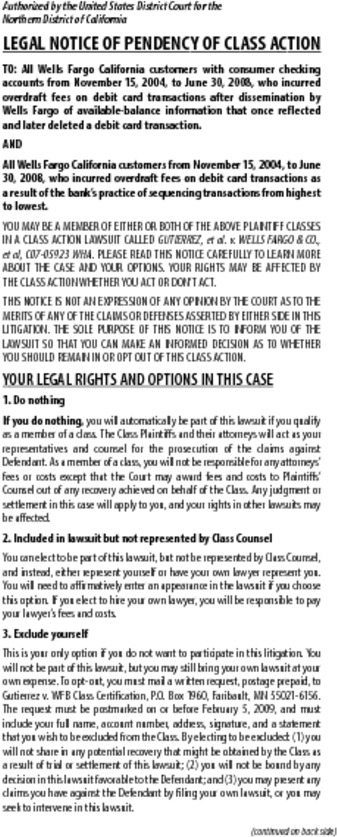

Got Wells Fargo? They've got a pending class action lawsuit on them for greedy practices

Do you have a Wells Fargo debit account in the Bay Area, or anywhere in the US for that matter?

Did you ever check your balance online and find that a transaction was posted and then mysteriously disappeared? Of course, you didn't think you got whatever you bought for free, but perhaps thought the transaction was not final yet and you had a little more money at your disposal that day than you first thought. Well, that was a trick they used to gull you (and me) into spending over what they had as your real balance, and then they hit us with that fat $30 overdraft fee for every transaction no matter how small (even little $5-10 dollar ones).

Sometimes a handful of transactions that amounted to no more than, say, $25 dollars could lead to well over a hundred dollars or more in overdraft fees.

And that's not the half of it...

If you missed that neat little trick about appearing and disappearing charges, you probably didn't miss this next little gem when you checked your accounts online. Say you had $130 in your account and charged something for $40 then $20 then maybe another $100, and you ended up $30 over your actual balance. Well, you'd think that would mean one overdraft charge for the last transaction that put you over your limit. If you thought that, you'd be wrong. Oh, sure, they'd appear in your online account info in the order you charged them -- at first -- but then they'd re-order them at the end of the day or the next day, largest to smallest. I noticed that re-arranging several times. And guess what? With the $100 transaction counting first, it would be the $40 one that would put you over your limit (ca-ching, one overdraft charge of $30, thank you very much) and then the $20 transaction would be charged last causing yet another overdraft fee (double ca-ching, thanks sucker). At $30 a pop, this easily adds up fast, way beyond what ever fairly should have been your single overdraft fee.

These accounting tricks that came into play in the early 2000s must have been filling their coffers quite nicely, when repeated over and over thousands of times with thousands of their customers that live barely paycheck to paycheck, affording the execs hefty bonuses and other perks.

I knew these things were going on, but I thought the first was some normal accounting irregularity of a complex electronic banking system, not realizing it was intended to gull me into overspending. I was fully aware that the second one was a deliberate practice of Wells Fargo to suck far more money out of me than they ever legitimately had claim to, but I assumed it was somehow legal in our wonderful world of bank deregulation and class war on the poor. Now it appears that it may not be legal, or at least that's what I'm hoping a judge decides. And I am thankful that someone has decided to seriously call them to account for their greedy practices, at least two of them.

Why I hadn't moved to a community bank or credit union before now is beyond me. Why I put up with this BS for so long is embarrassing. Ripped off hundreds of dollars every year and I just accepted it. Well, at least now, if either of these things happened to you in the last few years, you, like me, are automatically a Class Plaintiff and might get something back, after the lawyer's take their ginormous cut from any possible settlement. Go class action justice!!

Read below for specific wording of Class Action.

Did you ever check your balance online and find that a transaction was posted and then mysteriously disappeared? Of course, you didn't think you got whatever you bought for free, but perhaps thought the transaction was not final yet and you had a little more money at your disposal that day than you first thought. Well, that was a trick they used to gull you (and me) into spending over what they had as your real balance, and then they hit us with that fat $30 overdraft fee for every transaction no matter how small (even little $5-10 dollar ones).

Sometimes a handful of transactions that amounted to no more than, say, $25 dollars could lead to well over a hundred dollars or more in overdraft fees.

And that's not the half of it...

If you missed that neat little trick about appearing and disappearing charges, you probably didn't miss this next little gem when you checked your accounts online. Say you had $130 in your account and charged something for $40 then $20 then maybe another $100, and you ended up $30 over your actual balance. Well, you'd think that would mean one overdraft charge for the last transaction that put you over your limit. If you thought that, you'd be wrong. Oh, sure, they'd appear in your online account info in the order you charged them -- at first -- but then they'd re-order them at the end of the day or the next day, largest to smallest. I noticed that re-arranging several times. And guess what? With the $100 transaction counting first, it would be the $40 one that would put you over your limit (ca-ching, one overdraft charge of $30, thank you very much) and then the $20 transaction would be charged last causing yet another overdraft fee (double ca-ching, thanks sucker). At $30 a pop, this easily adds up fast, way beyond what ever fairly should have been your single overdraft fee.

These accounting tricks that came into play in the early 2000s must have been filling their coffers quite nicely, when repeated over and over thousands of times with thousands of their customers that live barely paycheck to paycheck, affording the execs hefty bonuses and other perks.

I knew these things were going on, but I thought the first was some normal accounting irregularity of a complex electronic banking system, not realizing it was intended to gull me into overspending. I was fully aware that the second one was a deliberate practice of Wells Fargo to suck far more money out of me than they ever legitimately had claim to, but I assumed it was somehow legal in our wonderful world of bank deregulation and class war on the poor. Now it appears that it may not be legal, or at least that's what I'm hoping a judge decides. And I am thankful that someone has decided to seriously call them to account for their greedy practices, at least two of them.

Why I hadn't moved to a community bank or credit union before now is beyond me. Why I put up with this BS for so long is embarrassing. Ripped off hundreds of dollars every year and I just accepted it. Well, at least now, if either of these things happened to you in the last few years, you, like me, are automatically a Class Plaintiff and might get something back, after the lawyer's take their ginormous cut from any possible settlement. Go class action justice!!

Read below for specific wording of Class Action.

Gutierrez v. WFB Class Certification

http://www.wfblawsuit.com

(Last updated on 11/26/2008)

This class action lawsuit was filed against Defendant Wells Fargo Bank on November 21, 2007.

Plaintiffs allege that Wells Fargo has a practice whereby certain debit card transactions are at first reflected in an available balance, but then are later deleted from the available balance, thereby misleading customers with inflated account balance information and inducing them to incur overdraft fees. Plaintiffs also allege that Wells Fargo, when posting debit-card transactions on a day, re-sequences those transactions from highest to lowest and thereby increases the number of overdraft transactions. Plaintiffs allege that these practices violate California consumer protection and unfair business practices laws and constitute fraud, negligent misrepresentation, and conversion. The lawsuit seeks monetary and injunctive relief from Defendant.

Wells Fargo denies all allegations of wrongdoing.

http://www.wfblawsuit.com

(Last updated on 11/26/2008)

This class action lawsuit was filed against Defendant Wells Fargo Bank on November 21, 2007.

Plaintiffs allege that Wells Fargo has a practice whereby certain debit card transactions are at first reflected in an available balance, but then are later deleted from the available balance, thereby misleading customers with inflated account balance information and inducing them to incur overdraft fees. Plaintiffs also allege that Wells Fargo, when posting debit-card transactions on a day, re-sequences those transactions from highest to lowest and thereby increases the number of overdraft transactions. Plaintiffs allege that these practices violate California consumer protection and unfair business practices laws and constitute fraud, negligent misrepresentation, and conversion. The lawsuit seeks monetary and injunctive relief from Defendant.

Wells Fargo denies all allegations of wrongdoing.

For more information:

http://www.wfblawsuit.com

Add Your Comments

Comments

(Hide Comments)

http://www.clossonsettlement.com/

Settlement possible in class action against B of A for being unfair to customers and essentially behaving in the same manner as Wells Fargo!

Settlement possible in class action against B of A for being unfair to customers and essentially behaving in the same manner as Wells Fargo!

Apparently penalties were incurred because it was an interest drawing account. B of A works within federal guidelines that make fees mandatory.

I was a Coast Commercial customer but Wells Fargo took over. They got me for a lot of overdrafts they have reversed part of them but it took a long while I am still out in the hundreds. I found out about this class action lawsuit by checking on line about my account. what I want to know is how do I get included for I wish to seek justice. My daughter also was greatly affected. According to the information online at wells fargo it gave options and the first thing it said was 1. do nothing 2. you can exclude yourself from the lawsuit. It also said that everyone who has had an account with them will be reviewed I just don't beleive them they are crooks!! I have left the bank in tears before. And am very distrusting of them. I hope someone will direct me on how I can include myself in this lawsuit.

I really hope it works. If they even go through my call history, I have hundreds of customer service representatives telling me that what is displayed is not to the fault of Wells Fargo, but of Quicken (the company that does the online servicing for WF).

The biggest thing I hope they do is have the ATM receipts say "account balance may vary." I hate depositing money on a weekend and then when Tuesday rolls around all of my purchases have an overdraft.. then the money shows... but I'm still negative.

I thought I was alone and a horrible consumer. The rearrangment thing has sucked thousands of dollars from me....

The only reason why I haven't gone to a County bank is because I do travel a bit, but now with online bill pay I know after I get my piece of what I lost back I'll be making the move too.

The biggest thing I hope they do is have the ATM receipts say "account balance may vary." I hate depositing money on a weekend and then when Tuesday rolls around all of my purchases have an overdraft.. then the money shows... but I'm still negative.

I thought I was alone and a horrible consumer. The rearrangment thing has sucked thousands of dollars from me....

The only reason why I haven't gone to a County bank is because I do travel a bit, but now with online bill pay I know after I get my piece of what I lost back I'll be making the move too.

Finally, i knew something was fishy with my money in my account, i just dont know much about law to do anything about this stuff.

I would have more than enough money in my account to cover my recent transaction, well, randomly certain transactions i had made earlier in the week would go bye bye, yet i didnt get the money returned so i would make a purchase, thinking i had been covered........well.....wrong, after the recent transaction would go through to my limit it would then post one (or more) of my older transactions making me go negative, 35 dollars each time, but the overdraft protection would not post to my account, not until the next day after i had been negative, all the 35 dollar fees plus the 5 dollar a day B.S charges, would make me so negative my paycheck is gone.

1 overdraft made, the 35 dollar fee....wait a few days and then the overdraft protection shows up way late. im negative 1k dollars, from one transaction that made me negative 75 dollars (wich i had enough to cover) yet somehow it wasnt enough. Eh.

im sick and tired of the dates changing on my transactions, i wouldnt purchase things for weeks......when i was low on cash, and then wow! transactions saying i got stuff at my local grocery store!

I would have more than enough money in my account to cover my recent transaction, well, randomly certain transactions i had made earlier in the week would go bye bye, yet i didnt get the money returned so i would make a purchase, thinking i had been covered........well.....wrong, after the recent transaction would go through to my limit it would then post one (or more) of my older transactions making me go negative, 35 dollars each time, but the overdraft protection would not post to my account, not until the next day after i had been negative, all the 35 dollar fees plus the 5 dollar a day B.S charges, would make me so negative my paycheck is gone.

1 overdraft made, the 35 dollar fee....wait a few days and then the overdraft protection shows up way late. im negative 1k dollars, from one transaction that made me negative 75 dollars (wich i had enough to cover) yet somehow it wasnt enough. Eh.

im sick and tired of the dates changing on my transactions, i wouldnt purchase things for weeks......when i was low on cash, and then wow! transactions saying i got stuff at my local grocery store!

I though my daughter & I were alone caught up in this vicious cycle, trying over & over, everyday, noon & night. receipts scattered everywhere trying to prove Wells Fargo's deception that was taking place. I called and discussed the fraudulent fee's, I went in because they were eating up our monies faster than we received them. At one point I went in took my statements. Showing her I couldn't be overdrawn. They replaced $75.00 but I went on to say they were eating up $200 to $400+ every two weeks. I had a $729.00 direct deposit on the 27th, I made two phone payments Allstate & car. On the 29th I was -$459. It was a cycle I couldn't stop! I went in again telling them to stop this, I have a Down Syndrome daughter & the money they taking is putting me behind in all my bills, rent, credit cards, I even had to resort to cash advance. Which was just to keep up. I was bringing home $2300 a month and couldn't even make it through the two week pay periods. At one point Wells Fargo's agent told me that I shouldn't be in the habit of using my ATM card for such frivolous things as a hamburger. I told her what I used my card for was my business and that I certainly would not have used it knowing I was paying $65 for a $1.00 burger. I showed them in person, mailed copies, spoke to departments on the phone. that the purchased were cleared each time. And "Steve" just snapped at me again, that they wait and all written checks take priority over ATM's I explained you cannot take checks that are written two weeks after and clear them ahead of past ATM's! "This is wrong! You are taking all my money!" his reply the same as the 7months of horror, "We are perfectly within the state of California's law to do it the way we do" I lost respect with my landlord, lost all my credit I was already trying so hard to fix before opening this account. can't use my cards, moved, & in debt to Cash advances! and they closed my account finally sending me threats of monies accumulating! They have taken well over $5,000. I cried so many nights trying to figure out how I could be so off, wrong & not getting it. I explained to them before opening this account I ran a construction office & rental office using Wells Fargo Bank for years I managed so many accounts plus my personal accounts and I have never had any problem. Every time I received my deposits half was already taken, they ate up my savings to cover the use of overdrafts they paid with charges. I couldn't believe it when I receive the notice in my statement that someone actually filed a suit. And with a name like Gutierrez because I felt they were treating me like a Mexican/Hispanic in a boat without a paddle!

Well this problem didn't stop November 2008, still WFB is doing the same procedure. After i called and made a complaint, one time they reduced that penalty to half as a "courtesy", but they still charged me because i called the banker, we have to stop that.

I just went to check on the status of this suit (which I am a part of) and the link is broken, the phone number is just a recording saying to "check back later". I actually noticed this around the end of 2007 and brought it to the WF branch rep's attention...she was surprised and stated that she wanted to look at her account now.

Also, VERY IMPORTANT, if you have an acct with them look at the top of your acct info screen and it states that "now the transactions are in chronological order" but THEY'RE NOT! It's exactly the same (except for the look and feel/design of the page). They're still taking transactions out yes, in chornological order, but re-arranging them from highest to lowest within each date.

Please tell me if anyone knows what happened with this? I did some Googling, but didn't find anything new...just this posting and that pdf that's got the phone and broken site link on it.

Also, VERY IMPORTANT, if you have an acct with them look at the top of your acct info screen and it states that "now the transactions are in chronological order" but THEY'RE NOT! It's exactly the same (except for the look and feel/design of the page). They're still taking transactions out yes, in chornological order, but re-arranging them from highest to lowest within each date.

Please tell me if anyone knows what happened with this? I did some Googling, but didn't find anything new...just this posting and that pdf that's got the phone and broken site link on it.

I just came from my own Wells Fargo branch where all of my four children and my husband and I have accounts and have never felt so condemned. I went in because originally my direct deposit checks posted and the ckecks I had written had not been withdrawn. after checking later I saw that the checks had cleared -- with an overdraft fee of $35.00 for both of them. I went into the bank and got into an intergrity slamminhg match with both a banker (who i knew since he was a new teller) and the "manager". Incidentally and this is not a racist remark but it seemed as thopugh this bank had changed from a bank that represented the Bay Area's diversity to another US domestic-outsourcing venture. It was like offshore banking in Puerto Rico. anyway, I was told that i should learn to balance my account and the manager told me he had not overdrafted since he was 13, what the hell does that have to do with me. anyway they left me sitting and I had to acall customer service who were equally criminal but agreed to refunding half of my overdraft fees ($35.00). I still felt ripped of and am taking this further. anybody else experience this?

Yesterday they took out $2.18 and then another transaction for $5.34; today they withdrew a $150 check that was put into ATM machine at 7 pm last night. I had money to cover the first two transactions however, since I post dated the check to another customer for tomorrow I figuared I was fine. WRONG! They said the $150 check was taken out of my acct first followed by the $5.34 then the $2.18; they charged me a $35 overdraft fee on each item. I am interested in getting in on the class action lawsuit.

Thanks,

Pissed off & broke!

Thanks,

Pissed off & broke!

These bastards got me too over and over again. I run a small business and have a considerable amount of traffic running through my account. They even went as far as holding my large deposits that way they could make sure they they could process a check that they had been holding for a week. They would see this a couple of days in advance run my check hold my deposit and start hammering my deposit with there overdraft fees.

Ive tried to keep up with there ever changing policy but, realize the only way to do this is to have a savings a luxury many of us, especially in these hard times cannot enjoy. These bastards are just adding to the lining of there pockets at our expense.

Ive tried to keep up with there ever changing policy but, realize the only way to do this is to have a savings a luxury many of us, especially in these hard times cannot enjoy. These bastards are just adding to the lining of there pockets at our expense.

I wanted to contribute to this forum even though it is nearly a year old now.

Upon a number of very specific problems involving various banks, I can state that Wells Fargo is far from the only bank involved with this practice. My story with several banks and credit unions has mirrored this story almost to a “T”. Repeating the same story is almost worthless except to say that I too have noticed such practices with Wells Fargo, Bank of the West, BBVA Compass, a local credit union, a local bank, and stories of the same actions by others I know.

The first thing I began to do was to keep track of my account by making screen prints via Adobe .pdf’s of my accounts every morning and every afternoon. This has shown that the bank has been deleting items and having them reappear days and even weeks later. I advice that anyone who is experiencing this problem to download a .pdf printer off the internet, (available for free) and print a .pdf of their account every day with the day and time that it was printed as the file name. I have collected over a megabyte of these prints of my account and can show a history of re-arranging accounts in order to acquire as much in the way of fees as possible.

It is of course up to the individual to keep track of their own finances, and to keep a good balance in their accounts. But I too recognize that having enough money can be tough, and when a bank strips you of so much in the way of income in “fees”, it causes you to fall behind.

Wells Fargo conducted such action in early 2001-2002 in addition to holding my deposits causing our account to fall into the red and pay literally our entire paychecks in fees. In February of 2002 Wells Fargo charged us over $1000 in fees for the entire month and refunded only $300 of that. In Late March of 2002, my wife and I had to file bankruptcy. Their (WF) theft of our money exceeded $10,000 in “fees” over a four year period. After reviewing my account, and following standard and customary practices, I should have been responsible for only around $1400 in actual overdrafts over four years. Instead I cannot account for over $8000. We closed our account in 2002 and switch to a credit union, that promptly started doing the same thing to us.

We purchased a house in Nov. of 2004, and the bank that picked up the mortgage? Wells Fargo.

It is now November of 2009 and in an attempt to keep the mortgage payment up, I had to make a partial payment to WF. The problem is that this incurs fees that then are paid when you make the next payment. Thus, you continue to accrue late fees and eventually fall behind on the mortgage.

I state this because it is the practice of this bank to do such things.

My current bank with my checking account practices such things as well. Bank of the West also is allowed by the State of NM to put 6 dollar a day fees for over the limit.

There is far, far more to all of this but it boils down to simple profiteering on part of the various banks. I am at least trying to keep my payments for my mortgage current, and unlike in times past, they now play hard ball to get money out of you simply because they can. What can be done? I have ideas, but who will listen?

Upon a number of very specific problems involving various banks, I can state that Wells Fargo is far from the only bank involved with this practice. My story with several banks and credit unions has mirrored this story almost to a “T”. Repeating the same story is almost worthless except to say that I too have noticed such practices with Wells Fargo, Bank of the West, BBVA Compass, a local credit union, a local bank, and stories of the same actions by others I know.

The first thing I began to do was to keep track of my account by making screen prints via Adobe .pdf’s of my accounts every morning and every afternoon. This has shown that the bank has been deleting items and having them reappear days and even weeks later. I advice that anyone who is experiencing this problem to download a .pdf printer off the internet, (available for free) and print a .pdf of their account every day with the day and time that it was printed as the file name. I have collected over a megabyte of these prints of my account and can show a history of re-arranging accounts in order to acquire as much in the way of fees as possible.

It is of course up to the individual to keep track of their own finances, and to keep a good balance in their accounts. But I too recognize that having enough money can be tough, and when a bank strips you of so much in the way of income in “fees”, it causes you to fall behind.

Wells Fargo conducted such action in early 2001-2002 in addition to holding my deposits causing our account to fall into the red and pay literally our entire paychecks in fees. In February of 2002 Wells Fargo charged us over $1000 in fees for the entire month and refunded only $300 of that. In Late March of 2002, my wife and I had to file bankruptcy. Their (WF) theft of our money exceeded $10,000 in “fees” over a four year period. After reviewing my account, and following standard and customary practices, I should have been responsible for only around $1400 in actual overdrafts over four years. Instead I cannot account for over $8000. We closed our account in 2002 and switch to a credit union, that promptly started doing the same thing to us.

We purchased a house in Nov. of 2004, and the bank that picked up the mortgage? Wells Fargo.

It is now November of 2009 and in an attempt to keep the mortgage payment up, I had to make a partial payment to WF. The problem is that this incurs fees that then are paid when you make the next payment. Thus, you continue to accrue late fees and eventually fall behind on the mortgage.

I state this because it is the practice of this bank to do such things.

My current bank with my checking account practices such things as well. Bank of the West also is allowed by the State of NM to put 6 dollar a day fees for over the limit.

There is far, far more to all of this but it boils down to simple profiteering on part of the various banks. I am at least trying to keep my payments for my mortgage current, and unlike in times past, they now play hard ball to get money out of you simply because they can. What can be done? I have ideas, but who will listen?

As of today found wfb new little scam. I checked online yesterday and saw a transaction posted from sunday. I checked today to find my act overdrawn, and the transaction that was already posted put back in the pending section so they could charge me another nsf fee of 35.00, and a new fee 5.00 continous overdraft fee daily. Let me know if anyone else has noticed this. I called them on it and they said oh we dont do that kind of stuff.

just like many of you i too have been ripped off by the bank for something that wasnt even my fault. I went shopping on a Saturday and spent money at four different stores each time the transactions going thru which wouldnt if i didnt have sufficient funds in my account. come to find out 4 days later a transaction went thru even though it wasnt supposed to and it was larger then any of the ones i spent at the mall that day so of course they took that first even though it was four days later and posted it first then all the others from the mall and whatever else i had bought between those four day leaving me with 9 overdraft fees. well the transaction that was not suppose to happen i got a refund check in the mail from the company and wells fargo is still not changing the fees. i dont think this should be aloud it took 360 dollars out extra that i didnt have to begin that was for bills and christmas!!! im glad to see im not the only one that this happens too

Identical scenario just happened to me. Spent afternoon disputing with the bank manager who was completely worthless. I had used debit card several days ago and had more then sufficient funds to cover. Today a check that was written yesterday....must also bank with WFB...came through. Well low and behold they cleared the check and charged 35 in NSF fees for each debit transaction from several days ago. This happened one other time and the bank manager, different bank location, reversed all charges stating that it is a bank error and that banks are changing their process in 2010 in an effort to avoid these types of situations. He stated that banks are getting huge media attention for basically "ripping off" their customers. I was so happy that he understood and took responsibility for basically stealing my hard earned money. Today unfortunately the bank manager said no way its not a banking error. He and his assistant both told different stories neither of which made any sense. I was furious and said I was going to contact an attorney. As I research I find I am so not alone. This is huge and needs to stop. If I was just out there writing bad checks I could understand but I work hard to manage mY account on a regular basis and watch my $ and spending closely. If it was my fault I would own it but its so not. They really are very tricky and manipulative and for lack of a better term....THIEVES!!!!!!

Anybody know who I can contact a litigation against Wells Fargo...overage charges, new checking account switch, 2 checking, and a saving account that could not cover me........etc......something happens for several weeks now and I am not sure it will be fixed.

Just want to make sure there are people out there that had the same problem.....my charges are totaling over $350....even I have plenty of money in both old and new checking account. Who do I take them to small claims or , who...??? the bank manager, regional manager in California? Now what!! Do I sit and take this or what!!!

Just want to make sure there are people out there that had the same problem.....my charges are totaling over $350....even I have plenty of money in both old and new checking account. Who do I take them to small claims or , who...??? the bank manager, regional manager in California? Now what!! Do I sit and take this or what!!!

Omg. I just...I'm infuriated. -550 over this. 18 OVERDRAFT FEES! They really got me! Wait til I talk to a lawyer. This is ridiculous. And sadly, after talking to CS and them informing me that I "signed a contract basically allowing this", I "took responsibility for my...um...well not my actions...my actions were in an entirely different order...so I have to 550 to THEM because they like to play games and reorder my transactions...unfortunately for THEM...I have receipts with dates as to when this money was spent. I KEEP my account "balanced" so, it's not even something where they can attempt to say "Well, if you were balancing your checkbook, this wouldn't be an issue. Um apparently it would. See, my husband and I recently split. We are still married and had filed taxes jointly. Direct deposit into his account and he'd then transfer it to me, which is how we've always handled money, as we both have our accounts with Wells Fargo. They only allow 1000 transfers at once, so the total my husband was transferring was split into 1,000 on Friday, 1,000 on Saturday...and 414 on Sunday...but...they wouldn't allow the 414 to even start until Monday, because the 2nd 1000 was already pending. Ok, so, with all this said, basically, I had some purchases and bills I was waiting on the return to go for, and went this weekend, through to Monday (which the more I think of THAT, it further angers me, because...until right now, I understood the "pending status's' but...this spending, nor the SINGLE overdraft, didn't even OCCUR, until Monday, the day which I already received the 414...(further confused now)...well, basically, however they processed it, they have it I guess so that I had an overdraft pending for when the 414 came out somehow...? (Not the case in my balance...but I accept the idea that I may have mistaken, not to mention that everything was completely out of order and out of sorts...so I have to now manually process this and figure out how their sh*t for math adds up the overdraft in there somewhere, likely by intentionally processing it just SO it overdrafts before processing the next deposit?...need to further investigate that.) So, anywho...somehowhttp://www...they managed to get me with this weekend bs, and these overdrafts, were NOT processed in my account, so...meanwhile, my available balance, and the math in my calculations (an iPhone app I use that keeps me good on what I have and where my money is going, so that way I have a glance at where my money is going...) well...because this hadn't hit apparently, the overdrafts hadn't either, so that, while I'm seeing one available balance both on their end, as well as in my calculations, I'm meanwhile completely unaware that I have any overdraft fees, not because of the include-delete...simply because they had yet to even INCLUDE any overdrafts...so...I spend based on the amount I HAVE, in both THEIR end, and my own, and in the LONG shot, I had ONE overdraft I allowed myself to do BECAUSE that same day (Monday) I loaned my sister $165 for her husband to get his medication, with the promise that they would be paying back Monday...today...so...I'm at Walmart...about to purchase a $6 item, and I went to check my account to make sure her repayment processed (because I DON'T assume, and as I've said, I check my balance often and keep it recorded as such)...to find my account...NEGATIVE $550. EIGHTEEN OVERDRAFT FEES...so...someone want to tell me...if I'm overdrawn...by anything...how does my OVERDRAFT total equal LESS than what's negative from their FEES? (18x31=$558) And...oh...they're SO courteous...they gave me back...half of 3 of them...that's less than giving me back 2 fees...hmmmm faulty banking? Somehow, $8 dollars costed me $550?

I've been dealing with Wells Fargo, and there scam for too long now, I dont even want to get into the whole deal, but its the same stuff that's happening to everybody else. Bank trickery,stealing and account manipulation, just to make the big man rich. The phrase "kick em while there down" has never made so much sense until now.

Wells Fargo should have never got bailed out by its Tax payers that they rip off everyday!

Wells Fargo should have never got bailed out by its Tax payers that they rip off everyday!

We made a deposit Saturday the 13th day of the month of $180.00 on Monday the 15th wells Fargo took out a reoccurring transfer of $25.00 bounced my payment of $170.00 on the 16th and charged me $33.00 in NSF fee they did not stop the recurring transfer or use my savings.

The reoccurring transfer from your checking of $25.00 that goes into your saving account is like a payment it lowers your balance, and you may get an NSF fee if your balance is close to the amount of a payment that needs to post. Wala! The bank makes money and your bill won't get paid. They tell you it is to help you save money but if you carry lower balances you will end up using all of your saving just to cover all the NSF fees from your checking account of payments not paid by the bank, and the companies to which you wrote the payments. Beware...

The reoccurring transfer from your checking of $25.00 that goes into your saving account is like a payment it lowers your balance, and you may get an NSF fee if your balance is close to the amount of a payment that needs to post. Wala! The bank makes money and your bill won't get paid. They tell you it is to help you save money but if you carry lower balances you will end up using all of your saving just to cover all the NSF fees from your checking account of payments not paid by the bank, and the companies to which you wrote the payments. Beware...

I got an email notification on Thursday the 18th of March stating that my account was overdrawn. Well my account was actually overdrawn on March 16th but they let two days of transactions to occur before they notified me. All 12 transaction were considered overdrawn so I had $390 worth of overdraft fees. However, if they debit my account by first in first out I would of had enough funds to cover all 12 transaction except for the last one which was the highest dollar value. The bank credited me for 5 transaction which totaled $160 dollars. I paid $230 of overdraft fees. I feel more like they ripped me off in overdraft fees.

Wow! I can't believe that they can do this?

Sharon

Wow! I can't believe that they can do this?

Sharon

For more information:

http://scooleygirl@mac.com

It never ceases to amaze me that when you put money in because you have an overdraft, Wells Fargo then immediately goes in and piles the overdraft fees. Without letting you know beforehand! Where do they think you're getting this money? The are forcing you to get deeper into hock... My landlady sat on several rent checks, then cashed them all at the same time...and, to top things off, they say my account doesn't qualify for overdraft protection... Have these people looked at the state of the economy? Do they understand the pressure that they are putting on their customers? I know you agree to this when you sign your account contract, but Wells seems to relish adding fee on fee on fee...and it's up to 35 dollars per overdraft now...so you'll eternally be trying to catch up when you get slammed with these...

I need to find a better bank.

I need to find a better bank.

No matter what Wells Fargo says they're GUILTY! Every time my wife called them about over charges she was told it is Policy to pay the higher transactions first because they assume you'll want those covered rather than smaller transactions. Now that is per several Customer Service Agents over the years.

The same thing happened to me. They hide some of your pending checks, then charge you a $35 fee for every single check that came in that day regardless if it was overdrawn. I was only over drawn $3. and they charged me FIVE $35 fees. They wouldnt even talk to me about it. They said that all 5 check contributed to me being overdrawn? You have to be kidding me. After this summer this practice is outlawed. You have to sign something that will let them do this. DONT SIGN IT! Who cares if your debit occasionally gets declined.

It was nice of our government to go and "bail out" Wells Fargo. Now where is the bailout for all the people they have been screwing with these overdraft fees. I had one check overdraft and got hit with more than 7 overdraft fees. How is this even possible? Im not paying it! Wells Fargo customers need to get together and file a class action lawsuit and make this greedy bank titan pay back the millions of hard-earned dollars they have STOLEN from their customers. I don't know if I will even bank with anyone again. I don't trust banks anymore...MY money is safer with ME!

I am also catching on to Wells Fargo greedy practices as well. It always looks as though I have more money, even though the charges are reflected in my balance. I use text banking, online banking in order to make sure I don't overdraw, and their only BS excuse is online banking, and text banking is only a tool. I told them you people are told to say that to cover your asses. If it's only a tool, then why have them. Yes they are very greedy, and I spend more time arguing with them and when you get off the phone with them, nothing is solved. I'm fed up with Wells Fargo, I am looking for another bank right this moment. good I thought it was me.

This bank is ridiculous! I just got off the phone with one of their representatives and they are full of crap. I too was charged two overfraft fees, both $35 each for purchases of $5 and $7 dollars which I made last week. They conviniently charged me an identity protection program fee of $12.99 first then the two purchases i made last week last. Therefore acquiring the overdraft fees. Why? this transaction was not supposed to be charged until tomorrow! The other transactions were made first! They don't help the situation any. I was disconnected i don't know how many times and i finally decided to email them. Lets just see what BS they try to give me......

Wells Fargo recently charged me nearly SIX HUNDRED dollars of overdraft fees and "excessive overdraft" fees on purchases that didn't even amount to a sixth of that amount. Their online banking system showed I had overdrawn my account, so I transferred the appropriate amount to cover the deficit. Okay! Wells Fargo Online Banking showed my account was in the positive by a healthy margin. I went to pay for dinner later that night only to have my card declined and to find out they had retroactively slapped me with hundreds of dollars worth of overdraft fees. They were even kind enough to go back and retroactively insert overdraft fees in my Account Activity at the proper dates and times despite not having done so earlier when I thought I had covered the deficit. Rational, thoroughly reasoned calls to Wells Fargo about how their system works to keep their poorer customers in perpetual debt to them (obviously the point) did no good. I asked the supervisor to at least tell me how much money needed to be put into my account to make it no longer overdrawn... I borrowed the amount from a friend and have since not used the account at all out of pure fear... only to have more overdraft fees and "excessive overdraft protection" fees applied to my account several days later, despite the account having more than the amount to cover the projected fees stated by the WF phone supervisor. It's been an absolute nightmare... this has destroyed my ability to pay rent this coming month and to enroll myself in classes next semester. The WF employees have been without a shred of empathy or rational understanding that their company acts maliciously to ruin their lower income customers. I want to close my accounts with them and get an account somewhere that isn't insanely draconian toward their customers... but I fear that it's the same with all banks and credit unions. I want my money back from Wells Fargo and for them to stop extorting cash from their customers! Time to put the cash back into the coffee can, I guess.

Can you let us know how to contact a group that is doing a Class Action Suit against Wells Fargo in Massachusetts?

We live in Orange, in the central part of Massachusetts, and wish to find a group closer to us.

We took on a Loan Modification which was totally unfair, and they only gave us a lowered amount of $40.00 less than the over $1,000 a month. They gave us incorrect information, and led us on and now, our credit could be ruined.

We cannot afford this mortgage, and we have proven that we do not have any food budget after paying out two mortgages, and two credit cards $500 a month for the credit cards. We have been using them for food and auto expenses.

Something must be done about these predatory banks.

We live in Orange, in the central part of Massachusetts, and wish to find a group closer to us.

We took on a Loan Modification which was totally unfair, and they only gave us a lowered amount of $40.00 less than the over $1,000 a month. They gave us incorrect information, and led us on and now, our credit could be ruined.

We cannot afford this mortgage, and we have proven that we do not have any food budget after paying out two mortgages, and two credit cards $500 a month for the credit cards. We have been using them for food and auto expenses.

Something must be done about these predatory banks.

Bank of America does the same thing!

I agree that overdraft charges of $35 for even tiny purchases are ridiculous, but I have to say that I have a problem with people who overdraw their accounts and then talk as if the devil himself ran their bank. Don't get me wrong; I've always been in favor of ONE reasonable overdraft charge assessed for a day in which someone overdraws their account, not multiple fees. But...

Where is the consumer's sense of accountability and responsibility? I manage a bank branch for a large corporate bank, and I am sick to death of hearing people badmouth us because they got careless and overdrew their bank accounts, resulting in an overdraft fee, even in the case of only ONE TRANSACTION. So rarely does a person want to take responsibility. God forbid we the bank should do what we warned we would do if the person overdrew their account.

IF YOU DON'T HAVE THE MONEY IN YOUR ACCOUNT, DON'T SPEND IT! Charges that disappear and then re-post later should not matter. Accidents happen, and I have reversed probably tens of thousands of dollars' worth of overdraft charges for my customers over the years. But when someone has obviously been careless, I have very little patience for them. It seems that so many people anymore are too lazy to keep a written record of what they've spent, yet only too happy to badmouth their bank when their carelessness gets them in trouble.

THE BANK POSTS THEIR ITEMS FROM LARGEST $ TO SMALLEST$. SO?! IF you're being responsible and tracking your balance properly, you don't have to worry about the mechanics of how your bank processes things, or whether a transaction disappears and re-posts later. (Funny thing about that - in most cases, the "disappearing act" has to do with the merchant's card processing service, NOT the bank that's paying the transaction.)

Are $150 worth of charges fair when the principal amount of the overdraft is only $25 - $30? ABSOLUTELY NOT.

On the other hand, do banks mind waiving these fees for someone who commits an accidental oversight once in a while? NOPE. I DO IT ALL THE TIME.

So man up, people. Be accountable. Acknowledge that tracking your account balance is YOUR responsibility. Keep a bloody check register, exercise a bit of care, and you'll never need to worry about overdrawing your account.

Where is the consumer's sense of accountability and responsibility? I manage a bank branch for a large corporate bank, and I am sick to death of hearing people badmouth us because they got careless and overdrew their bank accounts, resulting in an overdraft fee, even in the case of only ONE TRANSACTION. So rarely does a person want to take responsibility. God forbid we the bank should do what we warned we would do if the person overdrew their account.

IF YOU DON'T HAVE THE MONEY IN YOUR ACCOUNT, DON'T SPEND IT! Charges that disappear and then re-post later should not matter. Accidents happen, and I have reversed probably tens of thousands of dollars' worth of overdraft charges for my customers over the years. But when someone has obviously been careless, I have very little patience for them. It seems that so many people anymore are too lazy to keep a written record of what they've spent, yet only too happy to badmouth their bank when their carelessness gets them in trouble.

THE BANK POSTS THEIR ITEMS FROM LARGEST $ TO SMALLEST$. SO?! IF you're being responsible and tracking your balance properly, you don't have to worry about the mechanics of how your bank processes things, or whether a transaction disappears and re-posts later. (Funny thing about that - in most cases, the "disappearing act" has to do with the merchant's card processing service, NOT the bank that's paying the transaction.)

Are $150 worth of charges fair when the principal amount of the overdraft is only $25 - $30? ABSOLUTELY NOT.

On the other hand, do banks mind waiving these fees for someone who commits an accidental oversight once in a while? NOPE. I DO IT ALL THE TIME.

So man up, people. Be accountable. Acknowledge that tracking your account balance is YOUR responsibility. Keep a bloody check register, exercise a bit of care, and you'll never need to worry about overdrawing your account.

I was with Wells Fargo for many years, and never really noticed the overdraft problem until I lost my job and every penny was watched, Wells Fargo was kept showing that I had the money on the on-line statement and then when it became a problem they would say you must have read it wrong. To make a long story short, I had small purchases $2.30, $3.65,$5.95 and a couple big ones $200, $356, and $347, I started getting overdrafts $500.00 in fees, I put money into the account but then my auto payments came through, another $690.00 in fees, it ended up with me owning Wells Fargo over $1,500.00 and it started with a $5.95 overdraft yes it snow balled. I called Wells Fargo since I had been with them over 10 years I thought they would take care of it but no they were allowed to that. I feel they are taking advantages of the people that have lost their jobs in this horrible economy, I hope some of them lose their jobs and are out of work a few years maybe they will think about it before they rip someone off next time.

You are being just as dishonest as the banks. It's a lie that the merchants cause your transactions to disappear. I have multiple accounts at other banks, even BoA. BoA never did that, neither did any other bank I've used. ONLY WELLS FARGO TOOK TRANSACTIONS OFF OF MY BALANCE FOR SOMETIMES 2 DAYS. Hell, Forbes had an article about how horrible their bank practices were because it was a great bank for investors! Sure, pretend to have good CS to get customers, and then you charge them insane fees by removing charges and also rearranging your transactions. By the way, now that I'm at a credit union instead of these horrible 'banks' (really they are just scams...), I haven't had a single overdraft. It's amazing isn't it! People like me don't use check books anymore. We use our online banking, but Wells Fargo intentionally lies about your account balance using the aforementioned tricks. So it's hard to know when you have enough or not. I'm glad I went to a credit union. I should have done it years ago. The Bank Guy, you are the worst kind of person in the world. You have the nerve to blame US for your greedy institution openly lying and using creative (and highly unethical!) accounting to turn 1 fee into 10 and by removing transactions before reapplying them later. Typical bank employee...I just had some douche try to blame me for having a hold on my account. He said if I 'watched my money better, then it wouldn't happen'. Ya, that's right. He didn't even open my account yet. They put a hold on it because of a bill payment that was 'suspicious'. WTF! I PAID THE SAME BILL EVERY MONTH FOR FOUR YEARS! Oh well, at least I'm finally through with douchebags like you, The Bank Guy. I'll gladly stay at my credit union that forgives the first $100 in overdrafts. They are actually happy to have my business, and they show it. Unlike you 'bankers' (aka loan sharks on steroids).

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network