From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

PANIC DECLARED Empty store shelves, gas pumps, ATMs await.

Who am I to declare a panic? Don't worry about that yet; just stock up on a little cash and canned goods. When everything the feds do JUST MAKES THINGS WORSE -- we are in a panic. Not just grandpa's Depression, but a good old-fashioned running-scared panic when the shelves go bare (you can see it sporadically in some Targets now) because the stores or their venders run short on ready cash. A panic is a time when people hoard things and wait to be rewarded with lower prices, which of course do come.

One thing is sure: Capitalism as we know it is a goner. Already the government has nationalized an insurance company (AIG) and Bush is talking of taking an ownership stake in banks. I am not advocating or deprecating any economic system, but that is socialism. An upheaval this unprecedented will bring personal pain to all of us, and we better be prepared.

You'll need the cash if Bush declares a bank holiday, 1933-style (rumors of this have been circulating at Bank of America). You might not be able to get into a bank for a few days, and the ATMs will run out of money quickly. I'm not Chicken Little, and I don't want a reprise of the Y2K foolishness -- I said a "little" cash and food, not half a ton of rice.

NONE DARE CALL IT "PANIC"

Of course not. Who in the government or in business would want to be blamed for starting a panic? So it's like we all sit in the theater smelling the smoke and no one wants to shout "Fire!" So I'll do it: "F-I-I-I-I-I-R-E!"

PANIC is a sudden *unreasoning* terror often accompanied by mass *flight* (widespread panic in the streets), or

a sudden widespread fright concerning financial affairs that results in a "depression of values" caused by extreme measures for protection of property (as securities).

UNREASONING, A Key Word

The above is a dictionary definition, courtesy Merriam-Webster's. That's the real Webster's that shows how real (honest, sane, common) people use words like "panic" -- not how economists (mostly always wrong), government minions (self serving), or snake-oil / stock salesmen like TV commentators (like Jim Cramer) use words. Note that the US / world financial tailspin has reached the point where the stock markets (best barometer of mass psychology) go DOWN NO MATTER WHAT THE GOVERNMENT DOES. Up some days, but mostly down -- no matter what. That's the "unreasoning" part. But as I show below, the fear does have some basis in fact. The financial situation ultimately is hopeless; it's just not yet a clear and present danger to life and limb.

As for "flight," it's not in the streets -- it's away from stocks and, especially, from debt for now. I wouldn't worry about flight in the streets for quite a while: I am not an alarmist after all. I would worry about flight from the bond market, if it starts, however, watching for bond prices to go down and percentage yields to go up drastically. If our Chinese and Arab friends (that we have treated so well) don't buy the US Treasuries the government must sell to bail us out financially, the US government will go broke.

DEPRESSION OF VALUES

As for the "depression of values" part from Webster's, that's one thing "depression" nearly always means in the economic sense -- "lower prices (nearly) always" (and not just at Wal-Mart) -- and of course depressed economic activity (growth less than nothing, characterized by years-long job losses). The lower prices can be seen now even at the gas pump (!); and house prices (the biggie for most people) and the stock market have collapsed. Even that old bugaboo, the price of oil has collapsed, from $147 to $88 a barrel last time I looked.

Lower prices in this situtation are associated with the term "deflation," meaning a deflation of the money supply. Unfortunately, since the early 1970s, and especially since about 1998, money has come to mean "fictitious money," or credit and financial instruments originating at the commercial banks, which is what the U.S. Federal Reserve really is (just a PRIVATELY OWNED superbank with special powers granted by Congress).

There is a small chance we could have a hyperflationary depression in which one would have to take a wheelbarrow full of cash to the store to buy groceries (as in Germany in the 1920s), but it sure doesn't look like it the way prices of some of our most important purchases are going now.

THE ROOT PROBLEM -- We have been on the wrong track since at least 1971-1973.

Unfortunately, since the early 1970s, and especially in the 2000s, money has come to mean "fictitious money," or credit and financial instruments originating at the Federal Reserve and other commercial banks. Money supply is no longer M3, the broadest official measure of the US money supply, nor M-anything else. Money today is basically credit, and it has been drying up in the credit markets since August 2007.

A CONTRACTION OF CREDIT *IS* A CONTRACTION OF THE MONEY SUPPLY

As the money supply, credit these days, goes down -- or the supply becomes seriously unavailable for consumption because people are UNWILLING to lend and borrow -- then prices go down. You can see it everywhere. Plummeting house prices and resulting subprime loan problems usually are cited as the real cause of the current financial collapse (they are not the real cause, as you can see). Even the prices farmers are getting for corn and soybeans are going down. Can even food prices be far behind? Why should I buy a car or a computer now, when in a few months I expect to be able to get one for a much lower price?

THE CLEAR-AND-PRESENT DANGER (Stock up.)

Of course you still have a job, credit, and a bank account. Of course you have some $20 Federal Reserve Notes in your pocket that you can take down to Kroger's or McDonald's to get something to eat. You're not foolish enought to count on there not being a run on the ATM machines. But what if your local food market, for example, Giant Eagle in the Pittsburgh area, has run out of cash? Maybe it can't get its commercial paper sold so it can meet its payroll and pay the truck driver to deliver to your store. Maybe its dairy supplier worries that he can't get paid by Giant Eagle within 60 days -- and of course he has his own cash problems. So you go to the store and you can't get milk. (Unless the government can fix the commercial paper crisis and many other crises to come. Which it can't.)

Of course the above is just an example. The shortage could be in any store, any commodity. That's why I recommend stocking up a little bit extra on the food and keeping the gas tank at least half full -- but not going nuts. (Giant Eagle, by the way, might be more financially secure than Kroger's, which is not the point.)

The point is that when the financial (money and its surrogates) system breaks down, the commercial and supply systems break down, too, and you can get hungry in a few short hours.

A SYSTEM THAT CAN'T BE FIXED

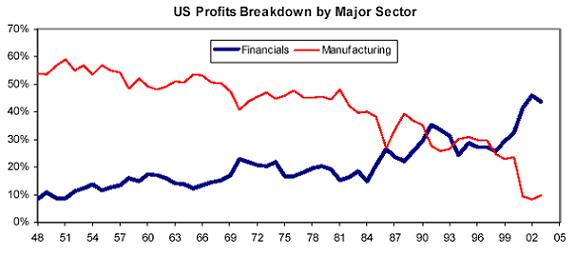

The government has a duty, and probably can fulfill it, to prevent mass privation and starvation. BUT THE PRESENT ECONOMY CANNOT BE FIXED. That's why they're already talking socialism. The reason is this: The financial system cannot be fixed, and today the financial system IS the economy (see the graph).

That the fianancial system can't be fixed is what you are seeing play out in the news every day. In a desperate last-gasp effort, the world's leading central banks have all cut their benchmark interest rate (most by a half percent), circling the wagons. The Dow probably will respond by going down, or up, but it doesn't matter. The financial system and the financial economy are doomed.

That might not be as bad as it sounds. After all, we have only been on the wrong track, economically, for 35 years or so, as the figure shows. It shows how the US went FROM MAKING THINGS (remember the mark "Made in USA"?) TO SHUFFLING PAPERS so that the mark on manufactured goods now overwhelmingly says "Made in China."

THE GRAPH SHOWS THE RISE OF THE "FINANCE-COMPUTER ECONOMY"

The manufacturing share of corporation profits began a slow decline in the 1950s as the financial share slowly rose. The shares stabilized in the 1970s even as the breakdown of the previous economy based on the Bretton Woods Agreement among the world's nations began to morph into a finance-computer economy. Bretton Woods pegged the world's currencies to the dollar, and the dollar to gold, and was based on the US being the world's workshop. The US decoupled from gold in 1971, the agreement was dead by 1973, and capital was deregulated somewhat and given unprecedented mobility.

WHY THE NORTEAST US DEINDUSTRIALIZED

Capital has increasingly sought out cheaper labor, especially in Asia, which is why the Northeast US deindustrialized -- especially in heavy industries like railroads an steel -- as the rest of the country prospered in the new economy of electronics, interstate highways, aerospace, defense and government activities, finance, health and other services, and paper shuffling of all kinds. The rich folks in the Northeast didn't mind, as they represented the Old Money (think Rockefellers and hundreds of other superrich families) made during the previous, manufacturing, economy and would do well no matter what. It was the Northeast's workers and cities that suffered. (Paradoxically, they might be in relatively good shape in the next depression, having taken their medicine early.)

Computers and electronic data communications (I was once part of that) aided the mobility of capital and the rise of the new finance-computer economy. The crash of this economy WILL MAKE THE TECH WRECK OF THE EARLY 2000s LOOK LIKE NOTHING to Silicon Valley as well as Wall Street.

The graph shows that in the 1980s the two economies in the US converged, equalizing just before the 1987 stock market crash. They stayed equal until about 1998 and then rapidly diverged in a reversal. As recently as the early 1980s, manufacturing had a 40% share of US corporate profits. Now that is about 10% and the financial share is about 40%, a complete reversal of roles. This is just not working, as you can see clearly in the media and everyday life, in late 2008.

CAPITALISM HAS BEEN "BROKE" FOR A LONG TIME

The fact is, the only thing that brought us out of the 1930s depression and deflation was WWII. After the war, rebuilding Europe and Japan, along with maintaining a war footing in the Cold War with the Soviet Union (the US never demobilized, despite all of the talk about it at the end of the war), kept the US economy busy and growing. By the late 1960s, competition from the efficient new factories of the rebuilt Europe and Japan made the US unable to remain the guarantor of the world's currencies. Remaining the guarantor threatened to empty Fort Knox of the gold reserves.

The fix was a switch to finance, shown in the graph, aided by cheap, fast data communications using computers and monitor screens (and eventually fiber optics) that allowed massive, instantaneous, real-time trading of financial instruments worldwide. (The deployment of large-scale-integration, LSI, microchips in computers, especially the microprocessor, from the early 1970s was a key.) This greatly increased the mobility of capital and enabled the proliferation of many unheard of financial instruments -- some accounting for hundreds of trillions of dollars that make the real manufacturing and services (nonfinancial) economy seem minuscule. We see these new instruments crashing around us today. The finance-computer economy enabled capital flight -- and with it, factories and jobs -- to the the US Sun Belt, and, especially, the Far East, but it will not survive in anything else like its present form. Maybe we will have to do real work and make real things again.

There is only one cure: rolling back the clock. Note that I am not advocating any economic system -- capitalism, socialism, communism, or anything else. Not now, even though capitalism as we know it is dying. But financial bailouts and rescues are not enough. The finance-computer economy dwarfs the resources of the world's governments, no matter how much money they print or create as electronic bits and bytes. Furthermore, there is no technological fix. Faith in technology (e.g., hydrogen as a medium for energy *storage*, or biomass-burning that we gave up 150 years ago with diamond-stack steam locomotives) is just false hope and helped to get us into the mess we are in. The only question, to me, about the rollback of the financial / economic clock is, How far back? Forty years? A hundred and fifty years? Farther back? The farther the rollback, the more disruption to social systems and pain to us. So, are we on the cusp of a depression-size wave, going back 80 years, or something bigger? -- Clayton Hallmark

You'll need the cash if Bush declares a bank holiday, 1933-style (rumors of this have been circulating at Bank of America). You might not be able to get into a bank for a few days, and the ATMs will run out of money quickly. I'm not Chicken Little, and I don't want a reprise of the Y2K foolishness -- I said a "little" cash and food, not half a ton of rice.

NONE DARE CALL IT "PANIC"

Of course not. Who in the government or in business would want to be blamed for starting a panic? So it's like we all sit in the theater smelling the smoke and no one wants to shout "Fire!" So I'll do it: "F-I-I-I-I-I-R-E!"

PANIC is a sudden *unreasoning* terror often accompanied by mass *flight* (widespread panic in the streets), or

a sudden widespread fright concerning financial affairs that results in a "depression of values" caused by extreme measures for protection of property (as securities).

UNREASONING, A Key Word

The above is a dictionary definition, courtesy Merriam-Webster's. That's the real Webster's that shows how real (honest, sane, common) people use words like "panic" -- not how economists (mostly always wrong), government minions (self serving), or snake-oil / stock salesmen like TV commentators (like Jim Cramer) use words. Note that the US / world financial tailspin has reached the point where the stock markets (best barometer of mass psychology) go DOWN NO MATTER WHAT THE GOVERNMENT DOES. Up some days, but mostly down -- no matter what. That's the "unreasoning" part. But as I show below, the fear does have some basis in fact. The financial situation ultimately is hopeless; it's just not yet a clear and present danger to life and limb.

As for "flight," it's not in the streets -- it's away from stocks and, especially, from debt for now. I wouldn't worry about flight in the streets for quite a while: I am not an alarmist after all. I would worry about flight from the bond market, if it starts, however, watching for bond prices to go down and percentage yields to go up drastically. If our Chinese and Arab friends (that we have treated so well) don't buy the US Treasuries the government must sell to bail us out financially, the US government will go broke.

DEPRESSION OF VALUES

As for the "depression of values" part from Webster's, that's one thing "depression" nearly always means in the economic sense -- "lower prices (nearly) always" (and not just at Wal-Mart) -- and of course depressed economic activity (growth less than nothing, characterized by years-long job losses). The lower prices can be seen now even at the gas pump (!); and house prices (the biggie for most people) and the stock market have collapsed. Even that old bugaboo, the price of oil has collapsed, from $147 to $88 a barrel last time I looked.

Lower prices in this situtation are associated with the term "deflation," meaning a deflation of the money supply. Unfortunately, since the early 1970s, and especially since about 1998, money has come to mean "fictitious money," or credit and financial instruments originating at the commercial banks, which is what the U.S. Federal Reserve really is (just a PRIVATELY OWNED superbank with special powers granted by Congress).

There is a small chance we could have a hyperflationary depression in which one would have to take a wheelbarrow full of cash to the store to buy groceries (as in Germany in the 1920s), but it sure doesn't look like it the way prices of some of our most important purchases are going now.

THE ROOT PROBLEM -- We have been on the wrong track since at least 1971-1973.

Unfortunately, since the early 1970s, and especially in the 2000s, money has come to mean "fictitious money," or credit and financial instruments originating at the Federal Reserve and other commercial banks. Money supply is no longer M3, the broadest official measure of the US money supply, nor M-anything else. Money today is basically credit, and it has been drying up in the credit markets since August 2007.

A CONTRACTION OF CREDIT *IS* A CONTRACTION OF THE MONEY SUPPLY

As the money supply, credit these days, goes down -- or the supply becomes seriously unavailable for consumption because people are UNWILLING to lend and borrow -- then prices go down. You can see it everywhere. Plummeting house prices and resulting subprime loan problems usually are cited as the real cause of the current financial collapse (they are not the real cause, as you can see). Even the prices farmers are getting for corn and soybeans are going down. Can even food prices be far behind? Why should I buy a car or a computer now, when in a few months I expect to be able to get one for a much lower price?

THE CLEAR-AND-PRESENT DANGER (Stock up.)

Of course you still have a job, credit, and a bank account. Of course you have some $20 Federal Reserve Notes in your pocket that you can take down to Kroger's or McDonald's to get something to eat. You're not foolish enought to count on there not being a run on the ATM machines. But what if your local food market, for example, Giant Eagle in the Pittsburgh area, has run out of cash? Maybe it can't get its commercial paper sold so it can meet its payroll and pay the truck driver to deliver to your store. Maybe its dairy supplier worries that he can't get paid by Giant Eagle within 60 days -- and of course he has his own cash problems. So you go to the store and you can't get milk. (Unless the government can fix the commercial paper crisis and many other crises to come. Which it can't.)

Of course the above is just an example. The shortage could be in any store, any commodity. That's why I recommend stocking up a little bit extra on the food and keeping the gas tank at least half full -- but not going nuts. (Giant Eagle, by the way, might be more financially secure than Kroger's, which is not the point.)

The point is that when the financial (money and its surrogates) system breaks down, the commercial and supply systems break down, too, and you can get hungry in a few short hours.

A SYSTEM THAT CAN'T BE FIXED

The government has a duty, and probably can fulfill it, to prevent mass privation and starvation. BUT THE PRESENT ECONOMY CANNOT BE FIXED. That's why they're already talking socialism. The reason is this: The financial system cannot be fixed, and today the financial system IS the economy (see the graph).

That the fianancial system can't be fixed is what you are seeing play out in the news every day. In a desperate last-gasp effort, the world's leading central banks have all cut their benchmark interest rate (most by a half percent), circling the wagons. The Dow probably will respond by going down, or up, but it doesn't matter. The financial system and the financial economy are doomed.

That might not be as bad as it sounds. After all, we have only been on the wrong track, economically, for 35 years or so, as the figure shows. It shows how the US went FROM MAKING THINGS (remember the mark "Made in USA"?) TO SHUFFLING PAPERS so that the mark on manufactured goods now overwhelmingly says "Made in China."

THE GRAPH SHOWS THE RISE OF THE "FINANCE-COMPUTER ECONOMY"

The manufacturing share of corporation profits began a slow decline in the 1950s as the financial share slowly rose. The shares stabilized in the 1970s even as the breakdown of the previous economy based on the Bretton Woods Agreement among the world's nations began to morph into a finance-computer economy. Bretton Woods pegged the world's currencies to the dollar, and the dollar to gold, and was based on the US being the world's workshop. The US decoupled from gold in 1971, the agreement was dead by 1973, and capital was deregulated somewhat and given unprecedented mobility.

WHY THE NORTEAST US DEINDUSTRIALIZED

Capital has increasingly sought out cheaper labor, especially in Asia, which is why the Northeast US deindustrialized -- especially in heavy industries like railroads an steel -- as the rest of the country prospered in the new economy of electronics, interstate highways, aerospace, defense and government activities, finance, health and other services, and paper shuffling of all kinds. The rich folks in the Northeast didn't mind, as they represented the Old Money (think Rockefellers and hundreds of other superrich families) made during the previous, manufacturing, economy and would do well no matter what. It was the Northeast's workers and cities that suffered. (Paradoxically, they might be in relatively good shape in the next depression, having taken their medicine early.)

Computers and electronic data communications (I was once part of that) aided the mobility of capital and the rise of the new finance-computer economy. The crash of this economy WILL MAKE THE TECH WRECK OF THE EARLY 2000s LOOK LIKE NOTHING to Silicon Valley as well as Wall Street.

The graph shows that in the 1980s the two economies in the US converged, equalizing just before the 1987 stock market crash. They stayed equal until about 1998 and then rapidly diverged in a reversal. As recently as the early 1980s, manufacturing had a 40% share of US corporate profits. Now that is about 10% and the financial share is about 40%, a complete reversal of roles. This is just not working, as you can see clearly in the media and everyday life, in late 2008.

CAPITALISM HAS BEEN "BROKE" FOR A LONG TIME

The fact is, the only thing that brought us out of the 1930s depression and deflation was WWII. After the war, rebuilding Europe and Japan, along with maintaining a war footing in the Cold War with the Soviet Union (the US never demobilized, despite all of the talk about it at the end of the war), kept the US economy busy and growing. By the late 1960s, competition from the efficient new factories of the rebuilt Europe and Japan made the US unable to remain the guarantor of the world's currencies. Remaining the guarantor threatened to empty Fort Knox of the gold reserves.

The fix was a switch to finance, shown in the graph, aided by cheap, fast data communications using computers and monitor screens (and eventually fiber optics) that allowed massive, instantaneous, real-time trading of financial instruments worldwide. (The deployment of large-scale-integration, LSI, microchips in computers, especially the microprocessor, from the early 1970s was a key.) This greatly increased the mobility of capital and enabled the proliferation of many unheard of financial instruments -- some accounting for hundreds of trillions of dollars that make the real manufacturing and services (nonfinancial) economy seem minuscule. We see these new instruments crashing around us today. The finance-computer economy enabled capital flight -- and with it, factories and jobs -- to the the US Sun Belt, and, especially, the Far East, but it will not survive in anything else like its present form. Maybe we will have to do real work and make real things again.

There is only one cure: rolling back the clock. Note that I am not advocating any economic system -- capitalism, socialism, communism, or anything else. Not now, even though capitalism as we know it is dying. But financial bailouts and rescues are not enough. The finance-computer economy dwarfs the resources of the world's governments, no matter how much money they print or create as electronic bits and bytes. Furthermore, there is no technological fix. Faith in technology (e.g., hydrogen as a medium for energy *storage*, or biomass-burning that we gave up 150 years ago with diamond-stack steam locomotives) is just false hope and helped to get us into the mess we are in. The only question, to me, about the rollback of the financial / economic clock is, How far back? Forty years? A hundred and fifty years? Farther back? The farther the rollback, the more disruption to social systems and pain to us. So, are we on the cusp of a depression-size wave, going back 80 years, or something bigger? -- Clayton Hallmark

Add Your Comments

Comments

(Hide Comments)

CHICAGO, Illinois (CNN) -- An outraged sheriff in Illinois who refuses to evict "innocent" renters from foreclosed homes criticized mortgage companies Thursday and said the law should protect victims of the mortgage meltdown.

Cook County, Illinois, Sheriff Thomas J. Dart says too many renters are being evicted for landlords' problems.

Sheriff Thomas J. Dart said earlier he is suspending foreclosure evictions in Cook County, which includes the city of Chicago.

The county had been on track to reach a record number of evictions, many because of mortgage foreclosures.

Many good tenants are suffering because building owners have fallen behind on their mortgage payments, he said Thursday on CNN's "American Morning."

"These poor people are seeing everything they own put out on the street. ... They've paid their bills, paid them on time. Here we are with a battering ram at the front door going to throw them out. It's gotten insane," he said. Video Watch Dart slam mortgage companies »

Mortgage companies are supposed to identify a building's occupants before asking for an eviction, but sheriff's deputies routinely find that the mortgage companies have not done so, Dart said.

"This is an example where the banking industry has not done any of the work they should do. It's a piece of paper to them," Dart said.

Don't Miss

* Economic chaos creates surge of homeless

* U.S. bank failures almost certain to rise in next year

* Fannie Mae forgives loan of woman who shot herself

* iReport.com: How hard have foreclosures hit your neighborhood?

"These mortgage companies ... don't care who's in the building," Dart said Wednesday. "They simply want their money and don't care who gets hurt along the way.

"On top of it all, they want taxpayers to fund their investigative work for them. We're not going to do their jobs for them anymore. We're just not going to evict innocent tenants. It stops today."

Dart said he wants the courts or the state Legislature to establish protections for those most harmed by the mortgage crisis.

In 1999, Cook County had 12,935 mortgage foreclosure cases; in 2006, 18,916 cases were filed, and last year, 32,269 were filed. This year's total is expected to exceed 43,000.

"The people we're interacting with are, many times, oblivious to the financial straits their landlord might be in," Dart said. "They are the innocent victims here, and they are the ones all of us must step up and find some way to protect." Video Watch sheriff announce he won't evict innocent tenants »

The Illinois Bankers Association opposed the plan, saying that Dart "was elected to uphold the law and to fulfill the legal duties of his office, which include serving eviction notices."

The association said Dart could be found in contempt of court for ignoring court eviction orders.

"The reality is that by ignoring the law and his legal responsibilities, he is carrying out 'vigilantism' at the highest level of an elected official," it said. "The Illinois banking industry is working hard to help troubled homeowners in many ways, but Sheriff Dart's declaration of 'martial law' should not be tolerated."

Dart was undeterred Thursday.

"I think the outrage on my part with them [is] that they could so cavalierly issue documents and have me throw people out of homes who have done absolutely nothing wrong," Dart said. "They played by all the rules.

advertisement

"I told them, 'You send an agent out, you send somebody out that gives me any type of assurance that the appropriate person is in the house, I will fulfill the order.' iReport.com: How hard have foreclosures hit your neighborhood?

"When you're blindly sending me out to houses where I'm coming across innocent tenant after innocent tenant, I can't keep doing this and have a good conscience about it."

Cook County, Illinois, Sheriff Thomas J. Dart says too many renters are being evicted for landlords' problems.

Sheriff Thomas J. Dart said earlier he is suspending foreclosure evictions in Cook County, which includes the city of Chicago.

The county had been on track to reach a record number of evictions, many because of mortgage foreclosures.

Many good tenants are suffering because building owners have fallen behind on their mortgage payments, he said Thursday on CNN's "American Morning."

"These poor people are seeing everything they own put out on the street. ... They've paid their bills, paid them on time. Here we are with a battering ram at the front door going to throw them out. It's gotten insane," he said. Video Watch Dart slam mortgage companies »

Mortgage companies are supposed to identify a building's occupants before asking for an eviction, but sheriff's deputies routinely find that the mortgage companies have not done so, Dart said.

"This is an example where the banking industry has not done any of the work they should do. It's a piece of paper to them," Dart said.

Don't Miss

* Economic chaos creates surge of homeless

* U.S. bank failures almost certain to rise in next year

* Fannie Mae forgives loan of woman who shot herself

* iReport.com: How hard have foreclosures hit your neighborhood?

"These mortgage companies ... don't care who's in the building," Dart said Wednesday. "They simply want their money and don't care who gets hurt along the way.

"On top of it all, they want taxpayers to fund their investigative work for them. We're not going to do their jobs for them anymore. We're just not going to evict innocent tenants. It stops today."

Dart said he wants the courts or the state Legislature to establish protections for those most harmed by the mortgage crisis.

In 1999, Cook County had 12,935 mortgage foreclosure cases; in 2006, 18,916 cases were filed, and last year, 32,269 were filed. This year's total is expected to exceed 43,000.

"The people we're interacting with are, many times, oblivious to the financial straits their landlord might be in," Dart said. "They are the innocent victims here, and they are the ones all of us must step up and find some way to protect." Video Watch sheriff announce he won't evict innocent tenants »

The Illinois Bankers Association opposed the plan, saying that Dart "was elected to uphold the law and to fulfill the legal duties of his office, which include serving eviction notices."

The association said Dart could be found in contempt of court for ignoring court eviction orders.

"The reality is that by ignoring the law and his legal responsibilities, he is carrying out 'vigilantism' at the highest level of an elected official," it said. "The Illinois banking industry is working hard to help troubled homeowners in many ways, but Sheriff Dart's declaration of 'martial law' should not be tolerated."

Dart was undeterred Thursday.

"I think the outrage on my part with them [is] that they could so cavalierly issue documents and have me throw people out of homes who have done absolutely nothing wrong," Dart said. "They played by all the rules.

advertisement

"I told them, 'You send an agent out, you send somebody out that gives me any type of assurance that the appropriate person is in the house, I will fulfill the order.' iReport.com: How hard have foreclosures hit your neighborhood?

"When you're blindly sending me out to houses where I'm coming across innocent tenant after innocent tenant, I can't keep doing this and have a good conscience about it."

For more information:

http://www.cnn.com/2008/US/10/08/chicago.e...

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network