The Economics of Building a Nuclear Power Plant in Fresno

History tells us that projected costs differ vastly from actual costs. Just look at the table below:

PROJECTED VS. ACTUAL COST OF SELECTED NUCLEAR POWER PLANTS

(in billions of dollars)

Unit Megawatts Initial cost estimate Actual cost

Millstone III (Massachusetts and Connecticut) 1,150 .400 3.82

Limerick 1 (Pennsylvania) 1,055 .344 3.80

Wolf Creek (Kansas) 1,055 1.03 2.93

Susquehanna 1 (Pennsylvania) 1,050 .665 2.05

Susquehanna II (Pennsylvania) 1,050 .720 2.05

Source: Public Utility Commissions in the respective states

http://www.21stcenturysciencetech.com/articles/spring01/nuclear_power.html

As you can see, actual costs range from 3 to 11 times projected costs. Nuclear proponents argue that much of the added costs are because of unnecessary environmental and safety regulations, politics and finance issues. Whatever the reason, the reality is that the actual cost would likely exceed $12 billion. If nuclear is such a good investment, why have no nuclear power plant ever been 100% privately funded? In Dick Cheney’s Energy Policy of 2003, Title IV, subtitle B: New Nuclear Plants , it authorizes the Department of Energy to provide 50% of the costs to build new reactors and there are no guidelines regarding interest rates and repayment of these loans. In layman’s terms, we heavily subsidize the building of the plant. We do not share in the profits of the privately owned plant and there is no guarantee our financing will be paid back? If it is so safe, why does provision Title IV, subtitle A: The Price Anderson Act limit the liability of nuclear power plants to $10B. A serious nuclear accident according to Sandia National Laboratories could cost upwards of $300B. Taxpayers will pay the difference.

John Hutson, Chairman of the PUC and President/CEO of the Fresno Nuclear Energy Group LLC, claims nuclear will bring jobs. Undoubtedly, but let’s look at the job creation comparison for different energy sources:

Table 1. Jobs Involved in Producing 1000 Gigawatt-hours of Electricity Per Year

Number of jobs: 10 116 248 542

Energy source: Nuclear fission Coal Solar thermal Wind

This 1993 finding by the Worldwatch Institute should still apply today on a comparative basis. There is no doubt that job creation for renewable energy exceeds that of fossil fuel and nuclear energy. Many states are ignoring the direction of the Federal government and finding more economic benefits in pursuing green energy.

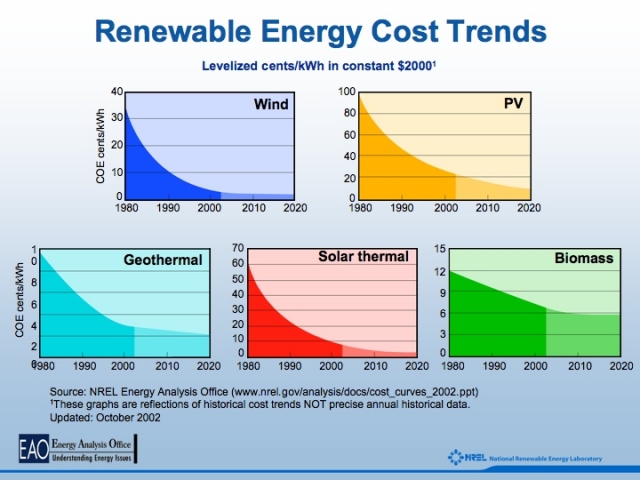

Since 1980 the cost of wind power has declined from $.30 - $.45 per kWh to $.05/kWh . The Federal Production Tax Credit, currently at 1.9 cents/kWh and indexed to inflation , further drives down the cost of wind power to ratepayers, allowing utility power purchase agreements to be signed as low as 3.5 cents. Solar photovoltaic (PV) is about $.20/kWh, and is now reduced with an expanded 30% Federal Investment Tax Credit, and the California Solar Initiative’s incentives for customer self-generation .

(Insert image: cost_curves_2002_Slide1.tif)

Nuclear power arguably costs $.03/kWh, only by ignoring large construction capital costs. According to the World Nuclear Association (WNA) report $.03/kWh represents operational costs and waste and decommissioning costs. How they account for waste cost is suspect since the Yucca mountain waste site still has not been approved. If it is approved today it will not be ready till 2017 . Meanwhile thousands of tons of nuclear waste from San Onofre, Diablo Canyon and Humboldt Bay are waiting. What’s not accounted for is construction and financing costs and most importantly, an investor’s required return on capital. According to the Ontario Power Authority’s assessment of the proposed CANDU 6 nuclear power plant, the cost per kWh to the consumer would probably be $.21/kWh when accounting for the required return on capital.

Let’s look at this from a more meaningful perspective. Regarding nuclear, there are four things the consumer needs to consider: 1) How much am I going to pay per kWh?; 2) Will the fuel cycle and generation cycle pollute our environment?; 3) Is it safe?; 4) How does it affect our national security? Each of these issues has a major economic impact.

What am I going to pay per kWh?

Currently, the average PG&E residential electricity rate is over $.16/kWh even though it costs about $.06/kWh for fossil fuel based generation. This should highlight the distinction between what you pay and what it costs to generate one kWh of electricity. Similarly what you will be paying for nuclear will far exceed the reported generation cost of $.03/kWh. As the Ontario Power Authority learned, it could be as high as $.21/kWh. It is expected that uranium 235 will be depleted by 2055 . As that limited resource gets scarce, we will see the cost per kWh rise.

Will the fuel cycle and generation cycle pollute our environment?

Conventional and in situ leaching methods of mining Uranium 235 result in radioactive contamination, lung cancer, respiratory diseases and contamination of ground water. Enrichment of uranium produces toxic hydrogen fluoride gas and large amounts of depleted uranium. Millions of gallons of water which will be radioactively contaminated are required to cool fuel rods. Our other featured articles will cover this more comprehensively.

Is it safe?

Since 1952 there have been about 301 nuclear accidents and 22 nuclear disasters . Maybe that’s why the Price-Anderson Act limits a nuclear corporation’s liability to $10 billion .

How does it affect our national security?

In an age where terrorism is such a major threat, putting in a nuclear power plant only makes Fresno a more attractive terrorist target.

How can we better use $12 billion?

If the Fresno Nuclear Energy Group is able to suppress local resistance, overturn the 30 year old State moratorium on siting new nuclear reactors, and overcome nuclear power’s equally old losing streak in the US investment capital markets, it will still have an uphill financial battle ahead, in the face of more promising alternatives. The proposed nuclear plant will have a capacity of 1600 MW which, assuming a manufacturer-specified 92% plant availability, translates to 12,895 GWh/yr . 92% plant availability is comparable with recent US nuclear plant fleet capacity factors published by the Department of Energy . 12,895 GWh/yr is roughly 4.5% of California’s annual consumption, which was 208,245 GWh in 2005. For comparison, we will take the Fresno Nuclear Energy Group at their word that this plant could be operational as soon as 2015.

Let’s look at what $12 billion can buy us invested in truly clean energy. The investors could put $12 billion into a solar power capital fund, which would be leveraged by Federal tax credits, Federal five-year accelerated depreciation, California Solar Initiative (CSI) incentives, rising utility rates, and rapidly falling solar photovoltaic/solar thermal electric costs.

This solar power capital fund would be available for the development of residential, commercial, agricultural, and public sector solar energy systems, using existing, commercialized technology. Rather than selling hardware, the investors could sell power from customer-sited solar power equipment they own, to Valley energy consumers (via “solar power purchase agreements”), at a guaranteed discount compared to PG&E and Edison (10-25% to guarantee rapid adoption). These solar power purchase agreements are a high yield, low risk return on investment. The combination of Federal and State incentives lead to a short payback period of roughly five years, with an ongoing “solar annuity” from the sale of power.

For the purposes of illustration, $12 billion could be used to develop 1.5 GW of customer-sited solar photovoltaic at $8/watt (CEC AC) in year 2006 prices . The California Solar Initiative will reduce over time, offset by reductions in PV system costs. Here is how the cash flow would look in this solar capital fund :

Initial capital investment: $12 billion

Federal 30% tax credit (first tax year): $3.6 billion

5 yr Accelerated Depreciation (net present value): $4.1 billion

CSI incentive/system cost reduction (five years): $5.4 billion

----------------

Capital investment – Federal/CA incentives: ($1.1 billion)

From this analysis, it is clear that the investors will have more than made their money back (a $1.1 billion profit, in fact), simply considering the Federal and State incentives returned to them in the first five years. For example, the solar capital fund will have been replenished by 2014 if the systems are installed over 2007-2008.

The exciting part: the investors’ solar capital fund would constantly be refilled by incoming Federal and State incentives, ready to roll into the next round of solar expansion. The Solar Energy Industries Association is optimistic that the 110th Congress will deliver an eight year extension of the Federal 30% solar Investment Tax Credit, recently extended through 2008. From 2009-2014, before the proposed nuclear plant could have sold a single kWh, a second 1.5 GW solar photovoltaic network could be financed by income from Federal and State incentives. This second 1.5 GW network will receive substantially less money from the California Solar Initiative than the first, but the planned decline in rebates will be synchronized with a decline in installed system costs.

The first 1.5 GW of solar photovoltaic systems will also be generating an estimated 2,800 GWh/yr (at 5.1 hours/day of noon-equivalent sun, based on Department of Energy data for Fresno) . If the average solar power purchase agreement retail cost of power starts at 10 cents/kWh, and the associated Renewable Energy Certificates (RECs) trade at a conservative two cents/kWh, this first 1.5 GW phase of development will be generating $336 million/year, or over two billion dollars in accumulated profit by 2014. By 2014, before the Fresno Nuclear Energy Group hopes to have an operational reactor, the solar capital fund would have fully manifested all 3 GW of the Governor’s California Solar Initiative, generating 5,600 GWh/yr, with roughly $1 billion/year in annual power and RECs sales. Since the Federal and California incentives for commercial solar development are so generous, they would have also returned the initial $12 billion investment back to the investors, twice over before a nuclear plant could be built.

The same $12 billion could then be used to capitalize a third round of solar power: 3 GW of solar thermal electric for wholesale power purchase agreements. PG&E and Edison have an obligation to by an increasing percentage of their supply from renewable energy resources under the Renewables Portfolio Standard, now 20% qualifying renewables by 2010. Governor Schwarzenegger is backing a goal of 33% qualifying renewables by 2020. Edison, SDG&E, and PG&E have recently signed one to two GW of solar thermal electric power purchase agreements to meet their 2010 goal. An unprecedented amount of renewables capacity will have to be added by 2020, creating significant market opportunities. This 3 GW, at an estimated $4/watt capital cost, would be based on single-axis tracking for higher output/watt capacity, yielding 7,665 GWh/yr.

We are now looking at 6 GW of solar photovoltaic and solar thermal electric systems, all developed on the same timetable as a 1.6 GW nuclear reactor, with substantially better tax effects and return on investment than a nuclear power investment could dream of. In fact, most of their original money is back in the investor’s accounts thanks to the Federal 30% Investment Tax Credit and five year Accelerated Depreciation. The solar investors are producing 5,600 GWh with customer-sited photovoltaic projects, and 7,665 GWh/yr with solar thermal power plants, generating 13,325 Gwh/yr of high value, peak period power. Compare this with 12,895 GWh/yr of baseload nuclear power.

Not only do the solar plants generate more power, they generate more valuable power for the investors. The photovoltaic solar power purchase agreements are retail, at over 10 cents/kWh plus REC prices, and the solar thermal electric are peak period Renewables Portfolio Standard contracts, significantly higher than the contract prices a baseload nuclear plant would command. Solar generates power where and when people need it, and California’s markets now reflect that. The solar investment delivers a higher ongoing electricity production and profit, at a much safer and lower after-tax investment.

How do we know that this solar power purchase agreement model works? It is already being using by a growing list of investors and project developers: GE Commercial Finance, Chevron Energy Systems, Honeywell, PowerLight/DEPFA Bank, MuniMae/MMA Renewable Ventures, HSN Nordbank, Regenesis Power, Nautilus Energy, and Solar Power Partners. In fact, the solar power purchase agreement was the financial structure selected by the Fresno Airport administration for their recent, successful one megawatt solar Request For Proposals. On January 10th of this year, Ted Turner announced that he was breaking in on the solar development action with an investment in DT Solar. California is expected to see over $20 billion of private investment in solar power by 2020, driven by the $3.2 billion California Solar Initiative and Renewables Portfolio Standard. Will the San Joaquin Valley take advantage of our natural solar resources to move into the clean energy future, or will we get stuck in the nuclear past?

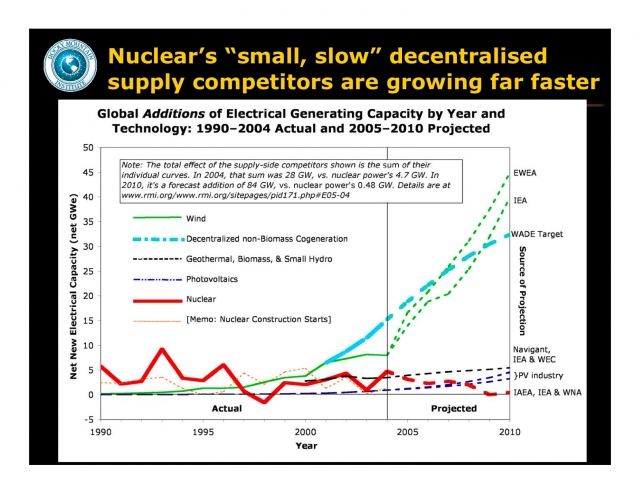

In our own back yard, the City of Fresno and the Farm Bureau are adopting solar PV solutions. OK Produce, in downtown Fresno, installed a 231 kW system in January, 2003, and PR Farms, in Clovis, installed a 1.1 MW system in July, 2005. Major corporations like Citigroup, PNC, Bank of America, Toyota, GM, Ford, Honda, Wal-Mart, Target, Home Depot, Lowes and Chipotle, to name a few, are going green . Despite what you have heard, there is a declining use of nuclear throughout the world because of cost, environmental concerns and safety . New nuclear power plant construction around the globe (France, Germany, Sweden, and Japan) have been reduced or eliminated entirely. Seven European plants were shut down in the first two weeks of 2007. Let’s not regress when the rest of the world is moving forward.

(See image: E06-04_NucPwrEconomics.jpg)

About the authors: Alan Cheah is a retired electrical engineer and software developer. Mark Stout handles Major Accounts for Unlimited Energy Solar Solutions, and is the Sierra Club Tehipite Chapter Air Quaility/Global Warming Co-Chair.

Endnotes:

http://www.taxpayer.net/greenscissors/LearnMore/2003%20Sen%20Nuclear%20Fact%20sht.pdf

http://www.taxpayer.net/greenscissors/LearnMore/2003%20Sen%20Nuclear%20Fact%20sht.pdf

http://www.greens.org/s-r/11/11-09.html

National Renewable Energy Lab (http://www.nrel.gov/analysis/analysis_tools_benefits.html)

http://awea.org/legislative/#PTC

http://www.gosolarcalifornia.ca.gov/csi/tax_credit.html

http://www.uic.com.au/neweconomics.pdf

“Nuclear burial site delayed” Fresno Bee, 14 Aug 2006, page B7

http://www.cleanair.web.net/resource/fs20.pdf

http://www.pge.com/rates/tariffs/ResElecCurrent.xls

http://www.physics.usyd.edu.au/~ned/warming/mills.pdf , page 8

http://archive.greenpeace.org/comms/nukes/chernob/rep02.html

http://www.cbsnews.com/htdocs/nuclear_disasters/framesource.html

http://www.greenscissors.org/energy/price-anderson.htm

http://www.areva-np.com/common/liblocal/docs/Brochure/EPR_US_%20May%202005.pdf, page 55

http://www.eia.doe.gov/emeu/aer/txt/ptb0902.html

http://www.energy.ca.gov/electricity/gross_system_power.html

http://www.sdenergy.org/ContentPage.asp?ContentID=136&SectionID=122&SectionTarget=44

Analysis performed for Fresno area location using the OnGrid Solar Financial Analysis Tool, http://ongrid.net/payback

http://www.seia.org/solarnews.php?id=128

IBID

http://www.cpuc.ca.gov/static/hottopics/1energy/r0404026.htm

http://www.cpuc.ca.gov/_spotlight/051102_renewableenergy.htm

http://www.stirlingenergy.com/breaking_news.htm

http://www.ceiinc.net/Download/Bethel%20Energy%20Solar%20Hybrid%20Project%20Overview%20-%20R3.pdf

http://www.dtsolar.com

Green Revolution, by Frank Geve, Fresno Bee, 17Dec2006, page E1

http://www.brook.edu/fp/cuse/analysis/nuclear.htm

http://www.greens-efa.org/cms/default/dok/164/164228.nuclear_power_plants [at] en.htm

Your article decries the subsidies that new nuclear construction receives, yet you promote "The Federal Production Tax Credit, currently at 1.9 cents/kWh and indexed to inflation" and a "30% Federal Investment Tax Credit" as an advantage for wind and solar power. (Note to readers: these fancy titles can also be simplified with one word: Subsidies). Existing nuclear plants receive no such subsidies.

Be careful what you ask for. Elimination of subsidies may hurt new nuclear construction, but it would mean certain death for solar and wind. But look on the dark side: Dirty coal doesn't need any subsidies to thrive.

As for costs, consider why so many utilities are buying these plants today at such premium prices? It's because utilities, which actually own power generation assets (unlike Enron) are generally run by savvy business men who know nuclear power plants have the lowest cost of any baseload electric generator. Period. If wind and solar are so cheap, then why aren't these savvy business men lining up in droves to build them?

Is it safe?

Your article cites 22 nuclear disasters. So, tell me then: How many people in the United States have been killed or injured as a direct result of nuclear hazards at a commercial nuclear plant? If you guessed more than ZERO, try again. Compare that to the number who are killed or injured from coal, and then ask the question "Is it safe?" Safer than what? According to real world data, working at a nuclear facility is safer than working in an office building.

These doomsday predictions may have given one pause 40 years ago when nuclear was just being built in this country. But today, nuclear power powers 1 in every 5 homes and businesses in the US, and provides 74% of the non-carbon-emitting energy. It is by far the most valuable player in the clean energy field. In the intervening time, nuclear plant workers have put literally millions of man-hours of time at these facilities, so if your predictions about health effects are true, then it should be expected that nuclear workers would be dropping like overripe grapefruits.

Wrong again. The people who actually work right there beside the reactor don't seem to be affected. Check out the studies and see for yourself. http://www.nei.org/index.asp?catnum=3&catid=1112

What is most ironic is that so-called environmentalists are actually the biggest obstruction to combatting global warming. Major wind farms, hydroelectric projects, and nuclear expansion - the very things that we need - are being blocked in part because of their potential environmental impacts. Yet, we continue to pour megatons of carbon dioxide into our atmosphere while we endlessly debate how we might stop climate change.

At least the founder of Greenpeace, Dr. Patrick Moore has seen the light. He and many other environmentalists are now supporting nuclear energy. See: http://www.casenergy.org/

First, the Energy Policy Act was not Dick Cheney’s and second it was passed in 2005 not 2003.

Third, I don’t know where it is found that the DOE is paying half the cost for a nuclear plant. There are loan guarantees which I think is what you meant but those apply to all “technologies that avoid, reduce or sequester air pollutants or anthropogenic emissions of greenhouse gases.” That includes solar and wind. For a fact sheet of the nuclear energy provisions in the EPACT 2005 go here: http://www.nei.org/index.asp?catnum=3&catid=1351

Fourth, you are correct that the Price Anderson act limits liability to $10B. However, the reason it exists is to entice investors to build new nukes. Without some form of limited liability, no one would want to build a plant. Do you know how much has been paid out of the nuclear insurance pool? $151M. “$70 million of which was related to the 1979 Three Mile Island partial core meltdown.” The Three Mile Island accident paid out less than 1% of the PAA cap. You can read more here: http://en.wikipedia.org/wiki/Price-Anderson_Nuclear_Industries_Indemnity_Act

Fifth, taxpayers will not necessarily pay the difference if an accident costs more than $10B. Congress decides. Check out the Wikipedia link above for more.

Sixth, “Will the fuel cycle and generation cycle pollute our environment?” No. Back in the 40s and 50s you could argue “radioactive contamination, lung cancer, respiratory diseases and contamination of ground water.” But not now. There are laws and regulations out there that prevent such things. And proper ventilation systems take care of the lung cancer and respiratory diseases.

Seventh. Where does this $12B number come from? I guess it is supposed to be 3 times $4B but that is quite an exaggeration. $4B for a 1,600 MW plant is excessive and I’m sure the Fresno Group was quoting that just to be conservative. For the first few nukes, the cost is expected to be about $2,000 / kW meaning the EPR should be about $3.2B.

Eighth. “Is it safe? Since 1952 there have been about 301 nuclear accidents and 22 nuclear disasters.” And like Mr. Stuart said, how many deaths have occurred? Zilch. And how much did the PAA pay out. Only $151M.

Ninth, it is not “expected that uranium 235 will be depleted by 2055.” There is ample uranium out there to last us at least 70 years according to recent estimates. And that’s just with known reserves. Every year we find more and more uranium. And we’re not even talking about reprocessing yet which we can reuse 95% of the used fuel to last us hundreds of years. For more info check out here: http://www.world-nuclear.org/info/inf75.html

I can appreciate the analysis done on how much solar $12B will buy California. Solar is very suitable there because the state gets quite a bit of it. However, the southwest is about the only area in the U.S. that gets enough sun so that we can use solar technologies. Considering that CA passed a climate change bill to reduce CO2 emissions, the state usually experiences rolling blackouts every year, CA’s electricity costs are one of the highest in the country and the air is one of the dirtiest, I would think a nuclear plant would be one the best things for the state. And I would think everyone there should be for it.

1) Nuclear Power Plants produce significantly less CO2 then fossil fuel power plants, but also less than wind and hydro power plants. If you do a complete analysis of CO2 production including mining, fuel processing, construction, and normal operation; CO2 production per GWe of electricity for a nuclear power plant is half of that produced by solar power. http://fti.neep.wisc.edu/pdf/fdm1181.pdf

2) Continuous Oversight. The NRC houses nuclear power plant experts at each and every nuclear power plant. The NRC also continuously reviews engineering, training, operations, maintenance, and management at each of these operating facilities. The NRC also reviews all new designs and changes to the nuclear fleet prior to approving the use in any operating nuclear facility.

3) Internal Oversight. Each nuclear power plant employees a department of individuals to provide oversight of their home facilities. The Quality Assurance personnel sole responsibility is to review work and decisions made by their peers.

4) Industry Oversight. The nuclear power industry has developed an organization called Institute of Nuclear Power Operators (INPO), where high potential candidates from each nuclear facility spend rotations working for INPO. During these rotations they provide expertise for plant questions and complete comprehensive plant evaluations where they document areas of improvement on themselves.

5) Safety. No one has died from a nuclear related accident at a power plant in the USA. That’s right, no one died because of Three Mile Island. Pennsylvania continued to study the residents that surrounded the TMI plant for 20 years to determine if an increase in mortality rate could be observed and it was determined that there was no significant correlation between the TMI accident and mortality rate. http://www.ehponline.org/members/2000/108p545-552talbott/talbott-full.html

6) Expectation of Perfection. The multiple layers of oversight works. In one of the most well known recent incidents at a nuclear power plant; the NRC levied a $5.4Million dollar fine as well as banned the engineer who provided false documentation of inspections. http://www.msnbc.msn.com/id/7589842/ When tritium leaks became a concern in 2005, the industry adopted tougher guidelines even though EPA standards on tritium levels in ground water was never broken. http://www.boston.com/news/local/connecticut/articles/2006/05/09/nuclear_industry_adopts_new_policies_on_radioactive_water/

7) Jobs – Building new nuclear power plants will create thousands of construction jobs, and depending on the design selection; hundreds of well paying full time jobs. These jobs will attract well educated, highly paid individuals to maintain the facility and to pay taxes in the local area.

8) Energy Independence. Uranium can come from many different sources including Canada, the USA, Russia, and Australian mines. None of which are located in the middle east.

2) Solar does not work at night. At all. So don't turn on your computers or TVs.

3) Solar PV lifespans and maintenance are not factored into your analysis.

4) Who stops the owners from selling the solar PV to outside California once CA has subsidized them?

5) Solar does not work on rainy days. Like most of February.

6) Solar does not work much each day during winter months.

7) Solar PV is a very dirty, high water usage and infinite long lived elemental waste producing product.

8) Wind is very noisy and kills birds. Lots of them. And no way to stop either side effect.

Still, a lot of good points, but somewhat one sided in analysis.

If you think I’m exaggerating. Ask San Luis Obispo County how much they spent dealing with the thousands of protestors who showed up to shut down the Diablo Canyon Nuclear Power Plant. Many of said protestors came from the Fresno Area.

Diablo Canyon is still on-line today, with over a 90% capacity factor, and is recognized as one of the top-performing plants in the industry. California's two little nuclear plants provide about 15% of the state's electricity and they continue to do so over 90% of the time. That's what we call "base-load power" in the electrical sector.

How is wind energy doing in the state of California? To be sure, California has the second highest installed wind capacity in the US, second only to Texas. For all of that capacity, wind can only eek out a dismally unreliable 1.5% of the state's electrical needs. And during the heat wave last year that killed many Californians, many of these windmills sat idle because the wind wasn't moving. That's what we call "supplemental capacity" in the electrical sector.

And before you start singing the praises of solar, take a look at the state's System Electricity Production.

Most people would say this is easier said than done due to the cost of purchasing and installing a system, but times are changing. A new solar company is making it easy for consumers to do the right thing by offering an elegant, win-win model for connecting homeowners to renewables.

It's now possible to rent a solar net metering system for roughly the same amount that you're now paying to the utility for electricity. In addition, customers' current electric rates will be locked in for the life of the rental contract, so they'll actually start saving money as energy costs go up.

It's an idea whose time has come, and it's going to make residential solar explode. More information about joining the solution at http://www.joinsolar.com .

How much you get paid to follow safe energy activists around guys?

I bet you guys keep pictures of Bush in your wallet!

By the way, everything they think they know or say is wrong.

By the way, this is not a good place to have any kind of serious diaglogue with these creeps. These assholes are into serious warfare against anyone opposed to nuclear power. IN OTHER

WORDS, YOU WILL HAVE A DATABASE STARTED ON YOU. So Chill out. There's other places to deal nuclear dung like this.

My last name is Bradish not radish. When was the last time I've heard that? Back in elementary school.

I as long as almost every other pro nuclear blogger out there I know of do not get paid for this. Regardless, I never see how that is relevant in these discussions.

And I as probably most other pro nuclear people don't care if someone is anti nuclear or not. As long as they have the correct facts and are still anti then that's perfectly fine.

David

Look at all of the countries that have nuclear plants under construction (25 plants now being built) and all of those who are planning to build. This isn't a George Bush conspiracy... it's just good energy sense on the part of countries that can open their eyes and make sane choices. Go ahead and build all the solar and wind you want, that's great, we will need that too. But Remember that Diablo Canyon and San Onofre are cranking out the megawatts all day, all night, and even when the wind isn't blowing. More of that kind of power will keep your lava lamps lit and your beans and sprouts chilled.

I applaud the Fresno group that is considering a nuclear build... they sound like a rational bunch to me, it beats the heck out coal, it will have more stable production costs than natural gas, and will provide the baseload power you need on those hot, still summer nights when your windmills and solar cells just sit there.

So are the San Louis Obispo Mother For Peace really the San Louis Obispo Mothers for Rolling Blackouts? More people have died skateboarding on Thursdays in LA than Diablo Canyon or San Onofre has ever killed or ever will kill. Thank God (if she's still allowed in CA) that the East Coast didn't follow the Left Coast's lead on Energy policy. I wish you guys well and hope you make better choices, including continuing to use nuclear power (and solar, and wind) as part of a diverse energy mix.

Bradish and Stuart expect there are curious and rational people who read this article and may wish to learn more. Therefore they share facts, figures and references for the use of anyone with an interest.

Note they do not call names and make personal attacks on anyone who intelligently disagrees. Actually, they didn't do that for you, either. But you did.

"corporate attack dogs ...mascarading as human beings"

"everything they think they know or say is wrong"

At least you did follow your own advice, "this is not a good place to have any kind of serious diaglogue with these creeps."

However, you seem to have this comment misplaced, "These ...s are into serious warfare against anyone opposed..."

Your fear-mongering will not win rational supporters to your cause, so one must assume you seek to mingle with like-minded people, not those who wish to educate themselves or others.

"IN OTHER WORDS, YOU WILL HAVE A DATABASE STARTED ON YOU."

"No matter what side of the argument you are on, you always find people on your side that you wish were on the other. - Jascha Heifetz"

Thank you for your opposition to nuclear as a clean, safe, baseload energy source.

1) Solar Cells are great… That’s right Solar Cells are great! But the problem is that most individuals can’t afford to retro-fit their homes with solar technology. Initial installation for an average home is somewhere around $19,000 out of pocket and in order to get a financial break-even point for the average household, it takes around 12 years. Not many of us can personally afford to make this investment. http://256.com/solar/

2) Alternative Power is great… That’s right alternative energy is great, but a capacity factor is the ratio of actual productivity in a year to theoretical maximum in that year. A well run wind facility will have a 35% capacity factor for wind facilities, 70% for coal plants, and 30% for oil plants. This is much lower than the 90% for nuclear plants. Personally, I don’t want electricity only 35% of the time. http://en.wikipedia.org/wiki/Wind_power

3) Wind Power is great… that’s right wind power is great, but only in the right locations. Most of California doesn’t receive a fast enough wind speed so it isn’t suitable for wind power development. http://rredc.nrel.gov/wind/pubs/atlas/maps/chap2/2-01m.html

4) Trees are great…. Wind turbines require around 0.1 square kilometres (0.0386 mi^2) of unobstructed land per megawatt of nameplate capacity. A wind farm that produces the energy equivalent of a conventional 2 GW power plant might have turbines spread out over an area of approximately 200 square kilometres (77.2 mi^2). The portions of California that do have a sufficient wind speed generally overlaps with our beautiful forest. I like the forest we currently have. I don’t want to clear any more trees. http://en.wikipedia.org/wiki/Wind_power#Ecological_footprint

5) Conservation is great! I can personally do my part; I can only hope everyone else is pitching in. Let us find common ground and identify a logical way to save megawatts without impeding anyone’s quality of life.

Nuclear Power is a safe, reliable source of power that can be increased to support our energy needs without adding greenhouse gases to our atmosphere, demolishing our forest, and will be available 24 hours a day, seven days a week.

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.