From the Open-Publishing Calendar

From the Open-Publishing Newswire

Indybay Feature

Warnings of a US recession and global slowdown

Three commentaries published in the Financial Times over the past week have pointed to the increasing likelihood of a US recession that would have major implications for the global economy.

In an article published on August 10 under the title “The world must prepare for America’s recession”, New York University economist Nouriel Roubini warned that while the US Federal Reserve Board may have been hoping for a “soft landing” when it decided earlier this month to halt its cycle of interest rate rises, the decision has come too late and it now confronts a recession.

“The US recession will be triggered by three unstoppable forces: the housing slowdown; higher oil prices; and higher interest rates. The US consumer, already burdened with high debt and falling real wages, will be hard hit by these shocks,” he wrote.

According to Roubini, the effects of the housing slump will be more severe than those that followed the collapse of the technology stocks bubble in 2000. This is because property comprises a much larger component of household wealth than technology stocks and about 30 percent of the increase in US employment since the recession of 2001 has been related to housing.

The latest US gross domestic product (GDP) figures were an “ominous signal” with consumption of durable goods falling, residential investment in “free fall”, and inventories on the increase as production confronts falling sales. “Higher investment in equipment and software, expected to offset lower spending on housing and consumption, is instead falling.”

More

http://wsws.org/articles/2006/aug2006/usec-a18.shtml

“The US recession will be triggered by three unstoppable forces: the housing slowdown; higher oil prices; and higher interest rates. The US consumer, already burdened with high debt and falling real wages, will be hard hit by these shocks,” he wrote.

According to Roubini, the effects of the housing slump will be more severe than those that followed the collapse of the technology stocks bubble in 2000. This is because property comprises a much larger component of household wealth than technology stocks and about 30 percent of the increase in US employment since the recession of 2001 has been related to housing.

The latest US gross domestic product (GDP) figures were an “ominous signal” with consumption of durable goods falling, residential investment in “free fall”, and inventories on the increase as production confronts falling sales. “Higher investment in equipment and software, expected to offset lower spending on housing and consumption, is instead falling.”

More

http://wsws.org/articles/2006/aug2006/usec-a18.shtml

Add Your Comments

Comments

(Hide Comments)

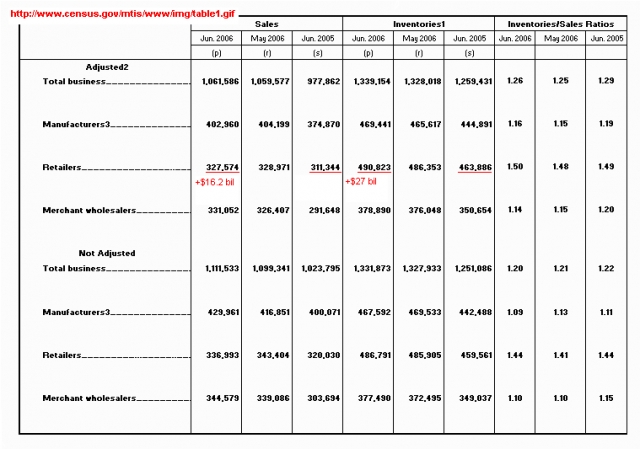

Retail Sales Decline: Harbinger of Recession?

The total nominal increase in July 2006 Retail Sales of $368.405 billion was 3.9% from July 2005's $354.414 billion. However, adjusting for inflation using the Bureau of Labor Statistics Consumer Price Index increase of 4.3%, this reduces the "real" Retail Sales change to -0.4%. However, the figures are even worse if gasoline station sales are subtracted. Subtracting July 2006's $43.918 billion in gasoline sales from the total nominal Retail Sales gives $327 billion. Subtracting July 2005's gasoline station sales from the total nominal Retail Sales (from July 2005) gives $319.53 billion. The difference between the July 2006's retail sales (ex. gasoline station) and July 2005's retail sales is only 2.3% in nominal (non-inflation-adjusted) dollars. Adjusting for inflation using the CPI increase of 4.3% puts the total at a -2.0%. In other words, excluding gasoline station sales, inflation-adjusted Retail Sales declined 2.0% from July of 2005.

This can be seen from the Retail Sales chart below copied from the U.S. Bureau of Economic Analysis report on Retail Sales

General Merchandise Sales, which make up the biggest component of Retail Sales, showed a nominal increase in dollar sales of 4.3%. (underlined in blue on the chart above.) Again, this is exactly the same as the increase in the Consumer Price Index of 4.3%. Thus, the real change in General Merchandise Sales since July of 2005 is 0.0%. In other words, there has been NO growth in General Merchandise Sales since July of 2005.

The declining inflation-adjusted Retail Sales numbers are an ominous sign for the economy. They're even more concerning when gasoline station sales figures are not included, which leaves the remaining total for Retail Sales at 2% less than the previous July. Even with increased borrowing, consumers spending is declining. Since consumer spending is 70% of GDP growth, it makes further GDP growth difficult, if not impossible. With consumer borrowing ability expected to fall even further, consumer spending will likely decline further as well. Real wages have continued their steady decline since December 2002. Median real family income has declined every year since 1999. With decreasing consumer spending and decreasing consumer demand, labor demand can be expected to decline even further. The declining labor demand will result in further declines in both wages and employment, reducing consumer spending power even further.

Several noteworthy economists are suggesting a recession is on the way. Paul Krugman has discussed this in his most recent article titled Intimations of Recession. Economist Nouriel Roubini, former member of Clinton's Council of Economic Advisors, has put the likelihood of Recession at 70% by the end of 2006. Another article from the Daily Reckoning has also laid out a strong case for an impending recession. All of these sources have provided a considerable amount of evidence to support their predictions. It appears that our "faith-based" economy is running out of steam. It can no longer be kept afloat by the hot air from the Housing Bubble and the alternate reality creation of the NeoCon-Artist spin machine.

unlawflcombatnt

EconomicPopulistCommentary

EconomicPatriotForum

_____________________________

The economy needs balance between the "means of production" & "means of consumption."

General Merchandise Sales, which make up the biggest component of Retail Sales, showed a nominal increase in dollar sales of 4.3%. (underlined in blue on the chart above.) Again, this is exactly the same as the increase in the Consumer Price Index of 4.3%. Thus, the real change in General Merchandise Sales since July of 2005 is 0.0%. In other words, there has been NO growth in General Merchandise Sales since July of 2005.

The declining inflation-adjusted Retail Sales numbers are an ominous sign for the economy. They're even more concerning when gasoline station sales figures are not included, which leaves the remaining total for Retail Sales at 2% less than the previous July. Even with increased borrowing, consumers spending is declining. Since consumer spending is 70% of GDP growth, it makes further GDP growth difficult, if not impossible. With consumer borrowing ability expected to fall even further, consumer spending will likely decline further as well. Real wages have continued their steady decline since December 2002. Median real family income has declined every year since 1999. With decreasing consumer spending and decreasing consumer demand, labor demand can be expected to decline even further. The declining labor demand will result in further declines in both wages and employment, reducing consumer spending power even further.

Several noteworthy economists are suggesting a recession is on the way. Paul Krugman has discussed this in his most recent article titled Intimations of Recession. Economist Nouriel Roubini, former member of Clinton's Council of Economic Advisors, has put the likelihood of Recession at 70% by the end of 2006. Another article from the Daily Reckoning has also laid out a strong case for an impending recession. All of these sources have provided a considerable amount of evidence to support their predictions. It appears that our "faith-based" economy is running out of steam. It can no longer be kept afloat by the hot air from the Housing Bubble and the alternate reality creation of the NeoCon-Artist spin machine.

unlawflcombatnt

EconomicPopulistCommentary

EconomicPatriotForum

_____________________________

The economy needs balance between the "means of production" & "means of consumption."

General Merchandise Sales, which make up the biggest component of Retail Sales, showed a nominal increase in dollar sales of 4.3%. (underlined in blue on the chart above.) Again, this is exactly the same as the increase in the Consumer Price Index of 4.3%. Thus, the real change in General Merchandise Sales since July of 2005 is 0.0%. In other words, there has been NO growth in General Merchandise Sales since July of 2005.

The declining inflation-adjusted Retail Sales numbers are an ominous sign for the economy. They're even more concerning when gasoline station sales figures are not included, which leaves the remaining total for Retail Sales at 2% less than the previous July. Even with increased borrowing, consumers spending is declining. Since consumer spending is 70% of GDP growth, it makes further GDP growth difficult, if not impossible. With consumer borrowing ability expected to fall even further, consumer spending will likely decline further as well. Real wages have continued their steady decline since December 2002. Median real family income has declined every year since 1999. With decreasing consumer spending and decreasing consumer demand, labor demand can be expected to decline even further. The declining labor demand will result in further declines in both wages and employment, reducing consumer spending power even further.

Several noteworthy economists are suggesting a recession is on the way. Paul Krugman has discussed this in his most recent article titled Intimations of Recession. Economist Nouriel Roubini, former member of Clinton's Council of Economic Advisors, has put the likelihood of Recession at 70% by the end of 2006. Another article from the Daily Reckoning has also laid out a strong case for an impending recession. All of these sources have provided a considerable amount of evidence to support their predictions. It appears that our "faith-based" economy is running out of steam. It can no longer be kept afloat by the hot air from the Housing Bubble and the alternate reality creation of the NeoCon-Artist spin machine.

unlawflcombatnt

EconomicPopulistCommentary

EconomicPatriotForum

_____________________________

The economy needs balance between the "means of production" & "means of consumption."

General Merchandise Sales, which make up the biggest component of Retail Sales, showed a nominal increase in dollar sales of 4.3%. (underlined in blue on the chart above.) Again, this is exactly the same as the increase in the Consumer Price Index of 4.3%. Thus, the real change in General Merchandise Sales since July of 2005 is 0.0%. In other words, there has been NO growth in General Merchandise Sales since July of 2005.

The declining inflation-adjusted Retail Sales numbers are an ominous sign for the economy. They're even more concerning when gasoline station sales figures are not included, which leaves the remaining total for Retail Sales at 2% less than the previous July. Even with increased borrowing, consumers spending is declining. Since consumer spending is 70% of GDP growth, it makes further GDP growth difficult, if not impossible. With consumer borrowing ability expected to fall even further, consumer spending will likely decline further as well. Real wages have continued their steady decline since December 2002. Median real family income has declined every year since 1999. With decreasing consumer spending and decreasing consumer demand, labor demand can be expected to decline even further. The declining labor demand will result in further declines in both wages and employment, reducing consumer spending power even further.

Several noteworthy economists are suggesting a recession is on the way. Paul Krugman has discussed this in his most recent article titled Intimations of Recession. Economist Nouriel Roubini, former member of Clinton's Council of Economic Advisors, has put the likelihood of Recession at 70% by the end of 2006. Another article from the Daily Reckoning has also laid out a strong case for an impending recession. All of these sources have provided a considerable amount of evidence to support their predictions. It appears that our "faith-based" economy is running out of steam. It can no longer be kept afloat by the hot air from the Housing Bubble and the alternate reality creation of the NeoCon-Artist spin machine.

unlawflcombatnt

EconomicPopulistCommentary

EconomicPatriotForum

_____________________________

The economy needs balance between the "means of production" & "means of consumption."

For more information:

http://www.unlawflcombatnt.proboards84.com/

We are 100% volunteer and depend on your participation to sustain our efforts!

Get Involved

If you'd like to help with maintaining or developing the website, contact us.

Publish

Publish your stories and upcoming events on Indybay.

Topics

More

Search Indybay's Archives

Advanced Search

►

▼

IMC Network